If you’ve been to a Sacramento Kings home game this year at the Golden1 Center in downtown Sacramento during a game where the team emerges victorious, then you’ve certainly heard (and perhaps participated in) the new spirited and energetic crowd chant: “LIGHT THE BEAM! LIGHT THE BEAM!”

Anointed as the “Beam Team” earlier this year, the Kings franchise is clearly on the upswing, trending strongly towards ending their league-long 16-year playoff drought and looking to land a spot in the NBA playoffs for the first time since 2006. Head coach Mike Brown and GM Monte McNair have assembled a very competitive squad that is seeing this playoff goal become more and more attainable with every win the Beam Team achieves, as the Kings have assembled a diverse squad of both veteran leadership and youthful energy and talent.

As the Beam (yes, we’ve decided to capitalize it) has become a point of pride and unity for our Sacramento community, it also is a metaphor for the state of downtown Sacramento in 2023. As Mayor Darrell Steinberg said at Tuesday’s twenty-sixth annual State of Downtown Sacramento speech:

The Kings rise and the shining of the beam is not a matter of dumb luck. And the truth is that the Kings rise was not a miracle brought on by a purple light, it was the result of careful planning, preparation, leadership, talent, and heart. Just like the downtown partnership and the people who have seen our downtown through its great rise, its most difficult times, and now get to be part of its inspiring comeback.

We’ve made a lot of progress: After ranking as the fifth most miserable city in America in 2012 according to Forbes, Sacramento in 2022 was ranked as NUMBER ONE California city to live in – what a turnaround!

The same trajectory is projected for the economy of Sacramento. Our Associate Wealth Advisor, Megan Miller, was one of almost 1,000 attendees at the State of Downtown Sacramento forum on Tuesday, held at the new SAFE Credit Union Convention Center, and afterwards she confirmed our opinion here at Towerpoint Wealth about downtown Sacramento: While we face big challenges, we are also firmly back “on the upswing” just like the Kings, and look forward to the continued unlocking of economic growth and expansion (and great food and entertainment!) that downtown Sacramento offers!

Understanding there are a myriad of different themes, topics, challenges, successes, and issues when it comes to the economy of Sacramento, below you will find a brief executive summary of the many positive catalysts creating Downtown Sacramento’s economic momentum and growth:

- This really cool list of current downtown development projects is growing quickly!

- Sacramento is growing its identity as a city of festivals:

- 44,000 people stayed overnight in Sacramento, and more than 160,000 people attended the West Coast’s Biggest Rock Festival, Aftershock, in 2022, with an estimated economic impact of $30 million

- Sacramento’s new country music festival, Golden Sky, drew 50,000 attendees last year, with an estimated economic impact of $12 million

- The Sol Blume R&B festival drew 40,000 people to Discovery Park in 2022, with an estimated economic impact of $10 million

- The Sacramento Midtown Association is bringing back our beloved Second Saturday Art Walk beginning this May – hooray!

- Sacramento’s hotel occupancy is at 99% of pre-pandemic levels.

- 684 new hotel rooms have been added over the past few years, including 179 at the new AC Marriott at 7th & I Street.

- Mayor Steinberg wants to add another 800 rooms in the next five years (perhaps the NBA All-Star Game will finally land here in Sacramento!).

- 1,089 new housing units have been built in the central city over the past four years

- 3,000 more units are currently under construction

- The NE corner of 10th and J Street, which has sat blighted for the past 15 years, was just sold to a housing developer planning to build 250 units

- The State of CA has made three state office buildings on Capitol Mall available for conversion to housing, with the prospect of a mixed-use urban village and up to 1,000 housing units looking more like a reality.

- Measure N was approved in November, allowing for an expanded use of “hotel tax” revenue to be used for economic development projects to create local jobs, visitor-serving facilities that promote tourism, economic development, and other activities that bolster the local economy, and theatre and arts venues.

- Revitalizing Old Sacramento and the Sacramento River waterfront are garnering more attention and capital

- A near $30 million waterfront makeover is back in the works, aimed at opening up the public market buildings with glass sides, creating a two-story platform and walking bridge to the embarcadero, and installing a new children’s play area in waterfront park

- CA State Parks is seeking input on design guidelines for a new 250 room hotel in Old Sac.

- SKK Development has asked the city for a loan to open a new Whole Foods midtown location at 16th and J Street, at the former Lucca Restaurant space, with 198 units of housing above it

This list is a lengthy and an exciting one, and by no means is it exhaustive or static. Here at Towerpoint Wealth, we expect that it will continue to evolve as our city does. The economy of Sacramento is on a roll, and we expect it to continue to grow and expand as the dynamism of downtown Sacramento follows suit!

Want to know more about the state of the economy of Sacramento and of downtown Sacramento overall? Check out the highlight video and the full 2022 Annual Report found below!

The Downtown Sacramento Partnership Annual Report measures the progress of Downtown Sacramento Partnership key programs and tracks the state of office, residential and retail market development activity in the urban core.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients save and invest for retirement while minimizing taxes.

The disruption. The grind. The time. The energy. The chaos!

Sometimes it feels like it takes more brains and effort to complete your taxes than it does to earn the income!

Are you a CPA, an EA, an attorney, a real estate advisor, or industry professional who serves clients and their income tax needs? If so, mark your calendar for May 4, as we look forward to celebrating the end of tax season with you at our first annual spring industry mixer, held at Revolution Winery & Kitchen!

If you want to feel confident in your retirement planning decisions, reach out to us and schedule a 20-minute “Ask Anything” call - we are confident it will be time well spent!

Here are some of our top trending moments at Towerpoint you might have missed on our social platforms.

Click the images below!

What else is happening with the Towerpoint Wealth family?

Today marks the one year anniversary of Russia invading Ukraine. The brutality and inhumanity that have defined the Russian campaign continues to be revolting and disgusting, reconciliation and a cease-fire seems obscure at best, and it remains extremely difficult to accurately predict and assess the political and economic implications that are still developing.

Many questions remain, with two at the forefront of our mind: Is peace a tangible possibility, and will justice ever be served? Additionally, what do peace, and justice, actually look like? Regardless of what these answers may be, securing peace and finding some kind of justice not only will teach Russia a lesson, but also to warn those in the future who might be tempted to make war crimes part of their military strategy. All of us at Towerpoint Wealth, while pragmatic about the situation, also hold out hope and faith that this conflict…this war…ends sooner rather than later.

We also believe that the unique economic issues and financial and investment themes and ideals that this war has created need to be addressed, and much of what we discussed in our initial March, 2022 message to you, our clients, still rings true today, and we encourage you to click the image below to watch what our President, Joseph Eschleman, originally had to say.

A Schedule D form is what most people use to report capital gains and losses that result from the sale of capital assets, including property you own and use for personal or investment purposes.

The capital assets you are most likely to report on Schedule D are the stocks, bonds, and real estate you sell in a particular tax year.

These gains and losses are categorized as either short-term (the asset was held for less than 12 months) or long-term (held 12 months or more).

Please reference Page 36 of the below 2022 Tax Form Guide from Charles Schwab for additional information on how to complete your Schedule D (and Form 8949, if necessary).

Additionally, and as mentioned two weeks ago, Schwab’s Tax Resources page has a plethora of useful information to help you make tax time a little smoother, plus important tax law changes that may affect your investment and tax planning decisions.

Have questions or concerns about filing your 2022 tax return?

We welcome connecting with you and are happy to help!

Click below to begin a dialogue with Steve Pitchford, Director of Tax and Financial Planning.

Useful and interesting content we’ve read over the past two weeks:

‘The Country is Watching’: California Homeless Crisis Looms as Gov. Newsom Eyes Political Future

KHN – 2.9.2023

Driving through the industrial outskirts of Sacramento, a stretch of warehouses, wholesale suppliers, truck centers, and auto repair shops northeast of downtown, it’s hard to square California’s $18 billion investment in homeless services with the roadside misery.

Tents and tarps, run-down RVs, and rusted boats repurposed as shelter line one side of the main thoroughfare. More tents and plywood lean-tos hug the freeway underpasses that crisscross Roseville Road, and spill into the nearby neighborhoods and creek beds.

Boomer Dads Are Driving Real Estate Agents Nuts!

Curbed – 2.10.2023

Last spring at a townhouse showing in Bedford-Stuyvesant, the agent David Harris watched his client, a married millennial with a kid, bounce from room to room before taking a seat on a staged sofa — a gesture Harris had come to regard as a cue that a client feels at home and is about to make an offer.

He was right. His client liked the place. Harris suggested they go $50,000 over asking, or $1.7 million; he anticipated a bidding war. His client agreed. But first, the client had to make one phone call. Harris watched as he went outside and started pacing. “And then he takes the cigarette out,” Harris said. “It was his father.”

‘Lake Tahoe Has a People Problem’: How a Resort Town Became Unlivable

The Guardian – 2.12.2023

Late last year, Lake Tahoe earned a spot on an exclusive travel guide. But the mountain destination, famed for its cobalt blue waters and Olympic-quality ski resorts, wasn’t there for the reason you’d think.

Fodor’s “No list” highlighted beloved getaways that needed a break, and Tahoe was up there with the neediest. Citing a pandemic influx of remote workers, second home buyers, traffic gridlock and packed beaches, the guide concluded “Lake Tahoe has a people problem”.

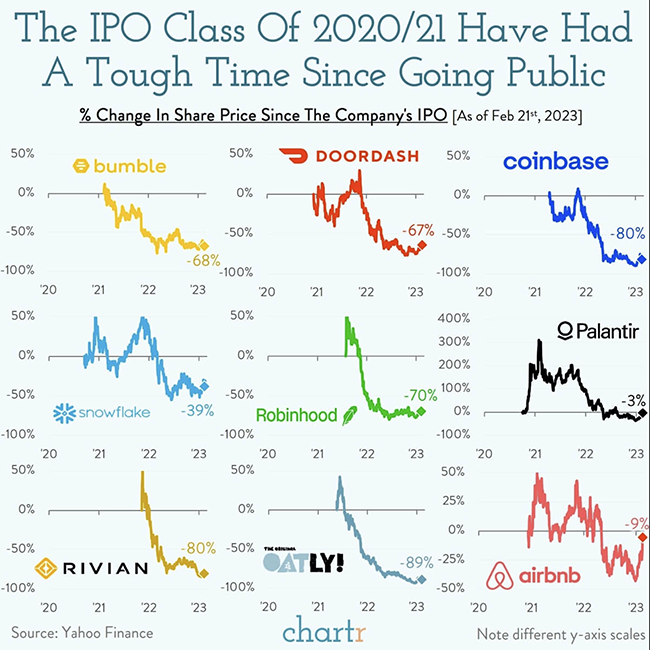

For fast-growing startups, an IPO is often the ultimate goal, a milestone after which the company has officially “made it” — but how is the class of 2020/21 getting on?

Robinhood, Coinbase, Airbnb and many other high-profile companies were among those to go public in the last 3 years, cashing in on frothy markets. However, since then, many have failed to live up to lofty expectations.

* Thanks to Chartr for the infographic and commentary.

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

At Towerpoint Wealth, we help you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement. If you are worried about how the 2024 election could affect your financial future, we welcome talking further with you about your personal situation.

Worried about whether you have enough set aside to retire? Check out our “Retiring with 2 Million Dollars” guide to learn five specific steps you can take immediately to work to grow your net worth!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast