Investing like the best is oftentimes simple, but not necessarily easy. It’s important to be prudent and disciplined, and one way to do this is to try to understand and embrace the mindset, outlook, wealth-building, and wealth-protecting philosophies of Warren Buffett.

As the Chairman of the Board for Berkshire Hathaway (NYSE: BRK), Buffett pens his Chairman’s Letter every year, highlighting BRK’s annual shareholder report. As has been the case since 1965, Berkshire’s 2022 annual report was released late last month, and scrutinizing Buffett’s Chairman’s Letter found within it continues to be a tradition for investors around the world. Considered a must-read, Buffett’s message this year was particularly anticipated, given today’s extremely unsettled and ever-changing economic and investing landscape.

While many believe that adhering to Buffett’s philosophies and principles is akin to investing like the best, the 92-year-old has certainly not been immune to criticism. Considered too conservative, too suspicious of technological advances, and too out of touch with modern markets, Buffett has his share of detractors, but his performance track record since taking over management and control of Berkshire Hathaway in 1965 is undeniable.

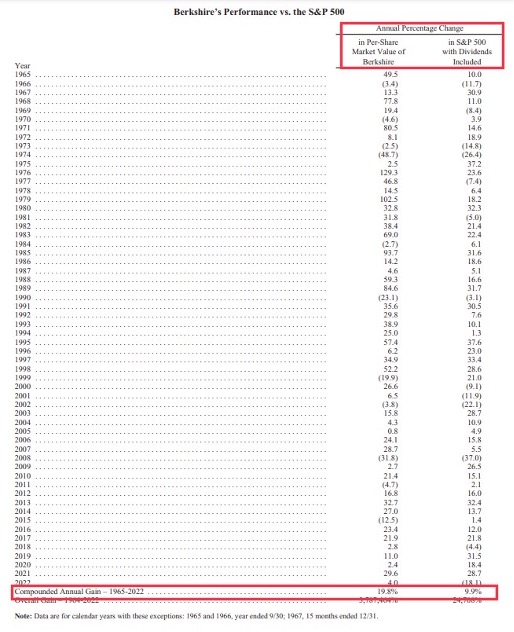

The stock market, as measured by the S&P 500, has grown +9.9% annually from 1965-2022. Berkshire Hathaway’s growth over the same time period? +19.8%.

Given this penchant for outperformance, it should come as no surprise that Buffett’s views and thinking are important to those who are interested in investing like the best. Key snippets from Buffett’s most recent letter, evincing his directness, common sense, and wisdom, are articulated below.

- The weeds wither away in significance as the flowers bloom.

Let your winners run – as your winning investments become bigger, the losers become less significant.

- It is crucial to understand that stocks often trade at truly foolish prices, both high and low.

Human beings, and investors, are emotional by nature. They oftentimes do the opposite of what they should, like buying high and selling low, which can drive stock prices artificially higher or lower.

- We are understanding about business mistakes; our tolerance for personal misconduct is zero.

Investing like the best doesn’t mean you won’t make occasional business mistakes, those are expected. However, bad behavior is not tolerated.

- ‘Bold imaginative accounting,’ as a CEO once described his deception to me, has become one of the shames of capitalism.

Buffett is skeptical of how CEOs use accounting gimmicks to help their companies achieve their short-term earnings goals. He also holds disdain for Wall Street analysts’ who provide quarterly earnings forecasts, as the threat of having to report “worse-than-expected earnings” can incentivize bad behavior.

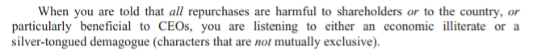

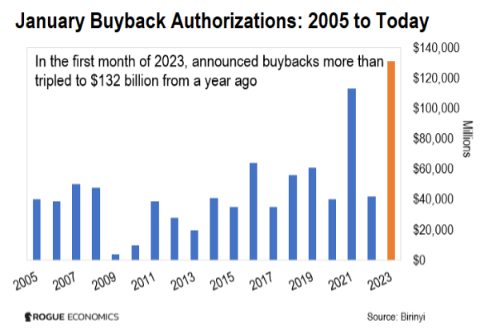

Additionally, and especially telling in light of the new 1% excise tax on repurchases of corporate stock that was enacted last summer as part of the Inflation Reduction Act of 2022 (“IRA”), were Buffett’s comments on BRK company stock repurchases:

Share buybacks have become a popular strategy for companies who have cash and no other intelligent way to deploy it. In lay terms, buying back their own stock on the open market helps to boost demand and increase the stock price. Also, buybacks help to improve key metrics like earnings per share (EPS), helping the stock to be more attractive to prospective investors. This is good for CEOs, and also helps to maximize value for shareholders.

At Towerpoint Wealth it seems evident to us that investing like the best and utilizing an approach like Warren Buffet’s requires patience, discipline, and a longer-term perspective. With those thoughts in mind, we encourage each of our clients, friends, and colleagues to strongly consider one of Buffett’s closing quotes in his 2022 Chairman’s Letter.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients save and invest for retirement while minimizing taxes.

We would like to congratulate our Partner, Wealth Advisor, Jonathan LaTurner, and his wife Katie McDonald, PHR, on the birth of their first child, Thompson William LaTurner, on 2/15/23!

Welcome to the Towerpoint Wealth family, Thompson - we can't wait to meet you!

Here are some of our top trending moments at Towerpoint you might have missed on our social platforms.

Click the images below!

What else is happening with the Towerpoint Wealth family?

The markets, politics, and economy are uncontrollable and unpredictable. However, income taxes and investing costs, while unpleasant, are unfortunately omnipresent. As you work to build and protect your net worth, investment expenses are unavoidable, and owning investments inevitably means you will be subject to paying income taxes as well.

The bad news? These two “necessary evils” are inevitable along your journey to growing and protecting your net worth. The good news? With intelligent and proactive planning, we DO have some control over reducing and minimizing both!

Click the Minimizing the Necessary Evils of Building Net Worth thumbnail below to learn more about specific strategies to reduce the drag on your nest egg and investment portfolio, allowing you to efficiently build and protect your wealth and net worth.

The More You Know About TAXES

As the 2023 tax season kicks into high gear, we would like to give you a few tips, debunk some myths, and get you some high-quality tax minimization strategies!

Click below to watch the first installment (focusing on tax withholding) of The More You Know About TAXES, a short yet impactful video series we have produced and designed to help make your tax season less stressful and hopefully save you some money!

Have questions or concerns about filing your 2022 tax return?

We welcome connecting with you and are happy to help!

Click below to begin a dialogue with Steve Pitchford, Director of Tax and Financial Planning.

Useful and interesting content we’ve read over the past two weeks:

World’s Largest Four-Day Work Week Trial Finds Few Are Going Back

Bloomberg – 2.28.2023

The largest-ever trial of the four-day work week found that most UK companies participating are not returning to the five-day standard, and a third are ready to make that change permanent.

The study involved 61 organizations and about 2,900 workers who voluntarily adopted truncated work weeks from June to December 2022. Only three organizations decided to the pause the experiment, and two are still considering shorter hours, data released Tuesday showed. The rest were convinced by revenue gains, drops in turnover and lower levels of worker burnout that four is the new five when it comes to work days.

Biden Bucks Liberals and Tells Democrats to Get Tough on Crime

NBC News – 3.4.2023

President Joe Biden’s decision last week on a local crime law sends a national message to fellow Democrats about how he believes they should address Republican criticism of the nation's rising crime rates.

Democrats have focused predominantly on police reform since the George Floyd protests reignited a national debate over race and law enforcement three years ago. But rising violent crime rates and growing perceptions of unease in major cities have prompted a chorus of party strategists and officials to call for a tougher approach to counter Republican attacks.

Effort to Ban Stock Trading Among Executive Branch Officials Renewed

The Wall Street Journal – 3.5.2023

Sen. Josh Hawley (R., Mo.) is expected to introduce legislation Monday that would ban senior executive branch officials from owning or trading individual stocks, a push to toughen restrictions on conflicts of interest in the federal government.

Mr. Hawley’s bill is the latest fallout from a Wall Street Journal series that identified a sweeping pattern of financial conflicts across the executive branch, including finding that more than 2,600 officials invested in companies overseen by their agencies.

If you want to feel confident in your retirement planning decisions, reach out to us and schedule a 20-minute “Ask Anything” call - we are confident it will be time well spent!

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

At Towerpoint Wealth, we help you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement. If you are worried about how the 2024 election could affect your financial future, we welcome talking further with you about your personal situation.

Worried about whether you have enough set aside to retire? Check out our “Retiring with 2 Million Dollars” guide to learn five specific steps you can take immediately to work to grow your net worth!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast