Why is talking about money so hard?

Be it with your spouse, partner, children, parents, friends, or colleagues, having conversations and talking about money can be stressful, and oftentimes loaded with emotion. We have been taught that money and finances are private, and that talking about money is impolite, even uncouth. Some facts from recent surveys from financial and market research firms, as quoted in the Atlantic:

- In 34% of cohabiting couples, one or both partners couldn’t correctly identify how much money the other makes

- Only 17% of parents with an income above $100,000 a year had told (or planned to tell) their children how much they earn or their net worth

People seem to be more comfortable talking with friends about marital discord, mental health, addiction, race, sex, and politics than money!

More often than not, when we think about talking about money, we channel deep feelings and vulnerabilities. Moreover, the cultural and societal attitudes around money can contribute to the discomfort and reluctance to have conversations about it. For example, some cultures emphasize the importance of being financially secure and self-sufficient, while others discourage discussion of personal finances.

Another reason why talking about money can be hard is that it can be tied to emotions and personal values. Money can represent security, independence, status, or even love and affection. When someone is asked to disclose their financial situation, they may feel like they are being judged or evaluated based on their wealth, income, or spending habits. This can lead to feelings of insecurity or embarrassment and can make it challenging to have an open and honest conversation about money.

Furthermore, money can also be a source of conflict in relationships. Differences in financial goals, spending habits, or attitudes towards saving and investing can create tension between partners, family members, or friends. Discussing money can bring up sensitive and uncomfortable topics, such as disagreements about budgets, spending priorities, or saving for the future. This can make it hard to have productive and constructive conversations about money.

Click the image below for an excellent set of resources from Capital Group, as their report talks about talking about money!

Talking about money can be challenging because of the cultural and emotional factors that are associated with it. However, it is important to have open and honest conversations about finances in order to achieve financial stability, security, and independence. Overcoming the taboo and discomfort associated with discussing money can lead to stronger relationships, better financial decision-making, and increased peace of mind.

As Carl Richards said: “I have a powerful exercise to help you get started. It’s a technique I’ve carefully crafted over thousands of hours of working as a financial adviser. It’s called ‘Just Start.’”

Here’s how it works: Grab the person you want to talk about money. And…. just start! That’s it.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients save and invest for retirement while minimizing taxes.

While gold underperformed other asset classes in 2022 due to a strong US dollar, recession fears on the horizon this year are causing some to be more optimistic about the outlook for gold in 2023.

One of the oldest investments out there, gold is considered a “safe haven” from inflation and geopolitical conflict, and massive government stimulus programs and money-printing.

Click the image below to read our white paper on gold, and message us with any thoughts or questions you may have!

Here are some of our top trending moments at Towerpoint you might have missed on our social platforms.

Click the images below!

What else is happening with the Towerpoint Wealth family?

Just last week the Towerpoint Wealth team headed to Folsom for our quarterly teambuilding day.

We had the pleasure of learning CPR, as well as the importance of knowing how to provide first aid in case of an emergency. Our half-day of training was provided by the Rescue Training Institute, and it was awesome!

We all left feeling much better prepared, and with a sense of security knowing we can now help and render first aid. Watch this short video recap of our day!

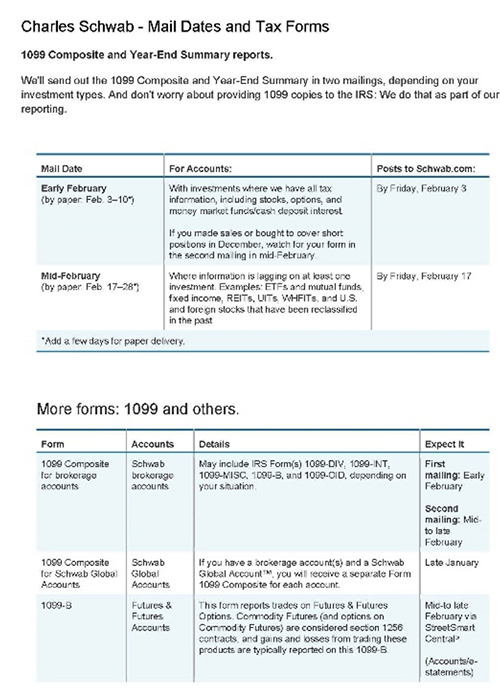

The 2022 tax season is no longer “right around the corner” – it’s now upon us! And part of this right of passage is the inevitable and time-consuming process of tracking down your various tax forms and other pieces of tax information.

If you are a Towerpoint Wealth client, then you are also a client of Charles Schwab, as we have chosen to partner with Schwab to provide custody of our client’s assets. And the inevitable question we receive from clients this time of year:

“When can I expect my 1099’s from Schwab?”

To better answer that question, click the image below to open and download a well-assembled fact sheet offering a timeline of the expected mail dates for the various Schwab 2022 income tax forms.

Additionally, Schwab’s Tax Resources page has a plethora of useful information to help you make tax time a little smoother, plus important tax law changes that may affect your investment and tax planning decisions.

Have questions or concerns about filing your 2022 tax return?

We welcome connecting with you and are happy to help!

Click below to begin a dialogue with Steve Pitchford, Director of Tax and Financial Planning.

Useful and interesting content we’ve read over the past two weeks:

Get Used to Face Recognition in Stadiums

Wired – 2.2.2023

While Madison Square Garden came under fire for using the technology, other venues are exploring their own uses of face algorithms, raising privacy concerns.

Calorie Restriction Slows Pace of Aging in Healthy Adults

Columbia School of Public Health – 2.9.2023

Eating less could help you live longer, a study found. Experts say slashing calorie intake slows the ageing process and reduces the risk of an early death.

Scientists think eating too many calories causes cells to age faster. It could even boost your health as much as quitting smoking. Researchers at Columbia University in New York looked at age-related damage on the DNA of 145 people after telling them to go on a diet for two years

More than 150 Years Later the Hunt for Gold is Still On in NorCal. This Year’s Winter Storms Bring a New Fever!

KCRA3 – 2.8.2023

The recent heavy rains in the Sacramento Valley created flooding in many of the streams and rivers. It also pushed gold from the mountains down into the valley, leading to a bit of a gold rush. It’s a modern day treasure hunt!

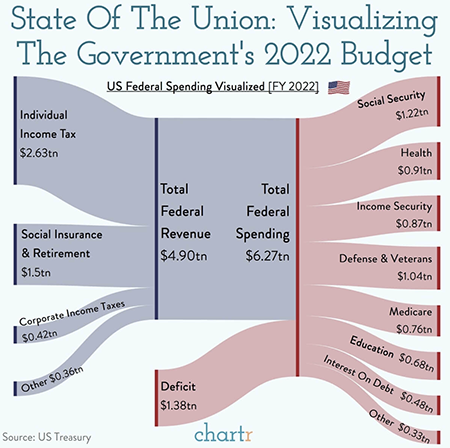

Our current I.O.U. - $1.4 trillion!

The latest budget from the US Treasury reveals that, in fiscal year 2022, the federal government collected nearly $5tn in revenue, with more than 50% of that coming from individual income taxes.

However, the US government spent even more, leading to a nearly $1.4tn deficit.

To make up the difference the US government does what everyone who overspends their budget does — they borrow. This then adds to the already enormous tab (AKA the national debt), which currently sits at the $31.4 trillion debt ceiling limit, a topic which received a fair amount of audience participation when brought up in Biden’s SOTU speech.

With a debt pile that big, the interest payments aren’t small. Indeed, last year the US government spent ~$480 billion on net interest payments!

* Thanks to Chartr for the infographic and commentary.

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

At Towerpoint Wealth, we help you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement. If you are worried about how the 2024 election could affect your financial future, we welcome talking further with you about your personal situation.

Worried about whether you have enough set aside to retire? Check out our “Retiring with 2 Million Dollars” guide to learn five specific steps you can take immediately to work to grow your net worth!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X