Updated October 24, 2024 -Different industries have their own top players, and in the tech industry, there’s a standout group of powerful high-performers in the sector, known as the Magnificent 7. These stocks have consistently proven their market dominance and innovative prowess, fueling a big advance in the value of their stocks over the past two years.

Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla. These seven stocks make up the Magnificent 7 and are most commonly recognized for their innovation, impact on the market and consumer behavior, and recent market dominance. Accounting for a large portion of the U.S. stock market’s growth over the past few years, the Magnificent 7’s earnings have also proven to be… well, magnificent!

HOWEVER, this begs the question - will the Magnificent 7’s earnings, and growth, remain magnificent?

Let’s talk about it!

Who are the Magnificent 7 stocks?

The Magnificent 7 are a group of high-performing stocks centered in the tech industry. Each of these seven companies makes up a massive portion of the market, with a total market cap of approximately $16.5 trillion as of October 22, 2024.

The magnificent 7 stocks include Alphabet (GOOG and GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA). All of these stocks are part of the S&P 500 and are household name brands that have revolutionized the technology sector.

Given the name in 2023 by Bank of America’s chief investment strategist Michael Hartnett, these seven stocks have been star players for 2023. Altogether, the staggering 75.71% Magnificent 7 returns were responsible for almost 2/3 of the S&P 500’s growth in 2023 – true market champions for the year!

It’s easy to see why these stocks were given the name “The Magnificent 7” in 2023, but will they live up to that reputation in 2024?

Magnificent 7 returns– How is 2024 stacking up against 2023?

In 2023, all seven of the Magnificent 7 returns enjoyed positive growth for the year, ranging from “only” +48% (Apple) to +239% (Nvidia). As we’ve discussed, the growth of the Magnificent 7 earnings was responsible for much of the return of the overall S&P 500 index. Without the Magnificent 7 earnings in 2023, the S&P 500 would’ve returned 9.94%, as opposed to the 26.3% return it did see for the year.

Will these stocks continue to dominate in 2024?

At Towerpoint Wealth, we don’t believe any of these stocks will become less innovative or important any time soon. The Magnificent 7 companies make the products we know and love. They have demonstrated their ability to adapt to economic changes and to drive innovation in the technology that we use on a daily basis.

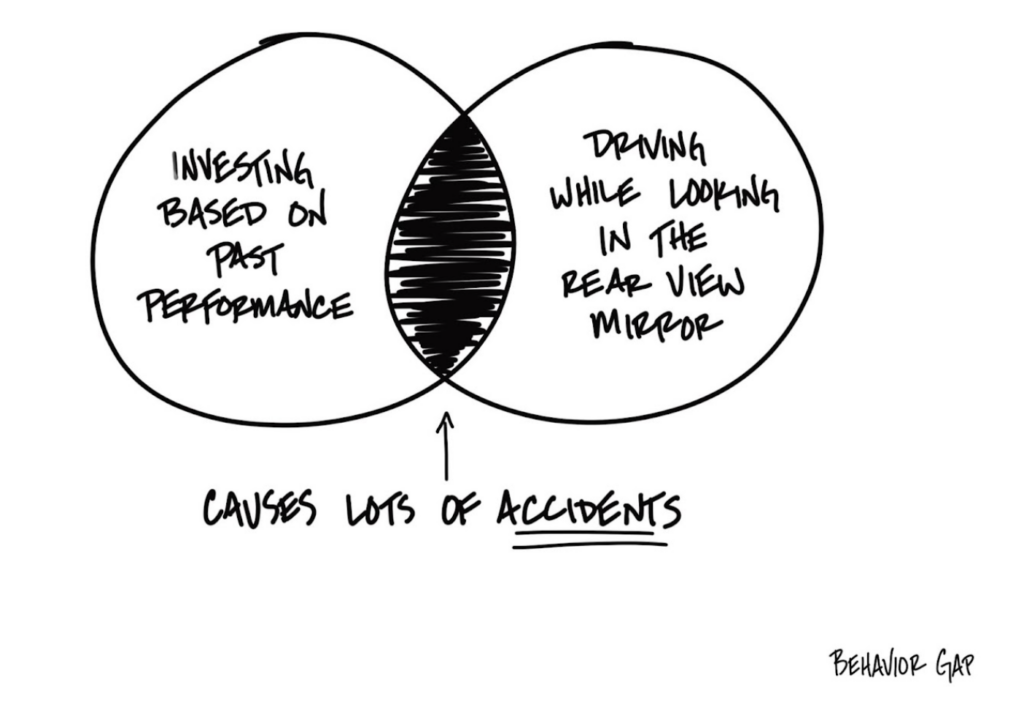

With that being said, the high performance of the Magnificent 7 stocks in 2023 may not be an indicator of the growth that these stocks will see in the future. The Magnificent 7 are not all enjoying the same success as they had last year, which can be concerning for investors.

Let’s take a brief look at each of these seven stocks to see the differences in their 2024 and 2023 performance.

Alphabet (GOOG and GOOGL)

Alphabet (formerly Google), is a global technology giant known for its dominance in internet-related services and products. The parent company of Google and its many former subsidiaries, Alphabet is one of the largest technology companies in the world and is what brings you Google searches, YouTube, and the Google Android operating system.

In 2023, Alphabet faced regulatory scrutiny and increased competition with AI. Despite these challenges, Alphabet stock managed to achieve a return of +58% for the year, enjoying solid revenue growth driven by AI advancements, the core Google services, and the company’s flourishing cloud business.

As of October 14, 2024, Alphabet has seen a YTD return of approximately +19.5%. Increased legal costs and investments in research and development have raised expenses for the company as a whole; however, Alphabet's ability to innovate and adapt to these external pressures underscored its resilience and long-term growth potential.

Amazon (AMZN)

Amazon started as an online bookstore and has since evolved into the world's largest e-commerce platform. It’s what brings you same-day delivery services, online streaming, and a wide range of on-demand cloud computing services.

Amazon stock experienced an +81% return for 2023. Amazon’s 2023 performance was attributed to its booming e-commerce and cloud computing services. Amazon Web Services (AWS) continued to dominate the cloud market, contributing significantly to the company’s overall profitability.

In 2024 Amazon has seen mixed results in its stock performance. Amazon's e-commerce business – the service that allows you to have something at your door almost as quickly as you can hit “Buy Now”– faced increased competition and supply chain disruptions, which challenged its growth trajectory. However, AWS remained a powerhouse, driving substantial revenue and profit margins. This has allowed the company’s stock to increase 21.8% YTD, as of October 1st..

While the company’s growth hasn’t quite lived up to its 2023 glory, it doesn’t look like Amazon is going to be giving up its market dominance in the near future.

Apple (AAPL)

Apple is renowned for its innovative consumer electronics, software, and services. The company is best known for its iconic products like the iPhone, iPad, Mac computers, and Apple Watch. Odds are, you may be reading this on one of their products.

The technology manufacturer had a profitable 2023, with over half its fiscal 2023 revenue coming from the iPhone. Apple stock saw a return of +48% for the year, though its sales slightly decreased from 2022 to 2023.

Apple has been able to stand out thanks to its product development and continued support. It doesn’t appear that this is going to change in 2024, with another new round of product and service offerings announced in June, but AAPL stock has NOT seen the same returns it saw last year. Unlike most of the rest of the Magnificent 7 stocks, Apple’s returns are trailing the S&P 500 so far in 2024. As of October 14, 2024, Apple has seen a YTD return of +17.5%, less than half of its 2023 return.

Despite this, Apple is still a major player in the industry and has the potential to bolster its performance with its new expansion into the AI industry. Unsurprisingly, AAPL will be worth keeping a close eye on throughout this year.

Meta (META)

Meta (formerly Facebook), operates some of the world's most popular social media platforms, including Facebook, Instagram, and WhatsApp. It has been increasing its investment in the development of its virtual reality space, called the Metaverse, and is hoping to revolutionize the way we interact online.

Meta had its fair share of challenges in 2023, with privacy concerns and regulatory pressures; however, it was still able to achieve a whopping +194% return for the year!

In 2024, Meta benefited from increasing ad revenue per user and advances in AI technology. The company’s strategic focus on growth and innovation in the online world has proven to be profitable. Meta stock has grown 62.9% YTD through the end of the second quarter, and many analysts believe it has a positive outlook for the rest of the year.

Microsoft (MSFT)

Microsoft is a leading technology company known for its software products like the Windows operating system, Office productivity suite, and Azure cloud services. The company has also enjoyed success in gaming services and consoles, as well as enterprise solutions like LinkedIn.

Microsoft’s performance in 2023, and the first half of 2024, was excellent. In 2023, Microsoft benefitted from the success of its cloud computing division, Azure, and robust demand for its Office 365 suite. The stock earned a +57% return for 2023, and many believe that this is due to the company’s relationship with OpenAI and its investment in AI technology services.

For 2024, MSFT stock has grown by +11.9%. Microsoft has demonstrated its commitment to investing in innovation for all of its offerings and continues to outperform the S&P 500.

Nvidia (NVDA)

Now it’s time for the BIG breadwinner for 2023 and 2024 alike – Nvidia. Nvidia, a leading player in the graphics processing industry, has seen massive growth in recent years. The company's GPUs are widely used in AI and machine learning applications, making Nvidia a key player in the technology industry’s artificial intelligence advancements.

Last year, Nvidia’s stock grew by +239%!

This year, the stock has already grown +136.3%% through the end of the second quarter. Part of the recent growth has been due to the company’s data center and AI investments, and NVDA’s solid financial performance has continued to underpin the growth of its stock value.

The stock is absolutely one of the hottest tech stocks in the game right now and doesn’t appear to be slowing down in the near future, including the company beating Wall Street’s sales and profit targets for its first fiscal quarter

Tesla (TSLA)

Tesla is a company specializing in electric vehicles (EVs) and sustainable energy solutions, known for its electric cars, battery energy storage systems, and solar products. Tesla vehicles probably catch your attention when you see them out on the road due to their innovative designs.

In 2023, Tesla earned a whopping +102% return. Advancements in the company’s electric vehicles and strategic price-slashing proved to be beneficial for Tesla throughout the year. 2024, on the other hand, is looking drastically different for Tesla.

Tesla is the biggest underperformer for the Magnificent 7 so far in 2024, with a +3.8% return for 2024 YTD through October 14, 2024. There are a few variables to blame for this, including increased competition in the electric vehicle market and underperformance in the company’s autonomous vehicles.

What does all of this mean for you as an investor? Should you incorporate the Magnificent 7 in your portfolio, or run the other way?

Well, as always, that depends on your preferences, investment philosophy, and risk tolerance.

The Magnificent 7 stocks are seven huge companies in the tech industry– and massive contributors to the growth of the overall stock market. All seven of these companies have demonstrated their ability to adapt, grow, innovate, and lead the market’s advancements.

Much of the technology that we use every day comes from one of the Magnificent 7, whether that be the physical product you’re using or the software you access on your devices, and we don’t see that changing any time soon. These companies have been able to continue to grow and innovate, leaning into market and consumer preferences for the development of new products and services.

With that being said, even the Magnificent 7 have periods of underperformance. Overall, the Magnificent Seven in 2024 haven’t all been able to maintain the performance they saw last year, and, like with any other stock, there is no promise of outsized returns at the end of each year.

Many believe that the Magnificent 7 does not live up to the title anymore – replaced by the “Magnificent One” (with Nvidia being the only major outperformer in 2024), or even the “Fantastic Four” or “Super Six”. We happen to believe that the entire group is made up of a fantastic 7 companies!

Should YOU invest in the Magnificent 7 in 2024?

It would be a serious breach of our fiduciary duty here at Towerpoint Wealth to suggest or recommend investing in any stock or group of stocks to a wide audience. Instead, discuss your investment decisions with your financial advisor, have a plan, and be disciplined in sticking to it. Your advisor can help you decide how much risk is tolerable for your portfolio, the appropriateness (or lack thereof) of any individual stock or investment, and help you make the right investment decision for your unique circumstances.

The bottom line is…

2023 was an amazing year for the Magnificent 7 stocks. Each of these seven high-performing tech stocks experienced outstanding growth in 2023 and earned their spot in this group, and while some have underperformed the S&P 500 for the first half of 2024, we still believe that the Magnificent 7 stocks are pretty magnificent!

Before making any drastic changes to your portfolio, it’s important to seek guidance from a trusted financial professional. At Towerpoint Wealth, our team of experienced Sacramento wealth advisors is here to help you make informed, strategic decisions that align with your long-term financial goals. Schedule a consultation today and ensure your portfolio is positioned for success.

Prefer to watch? Check out our YouTube channel!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity. We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on YouTube

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on X

Click HERE to follow TPW Podcast : A Wealth of Knowledge