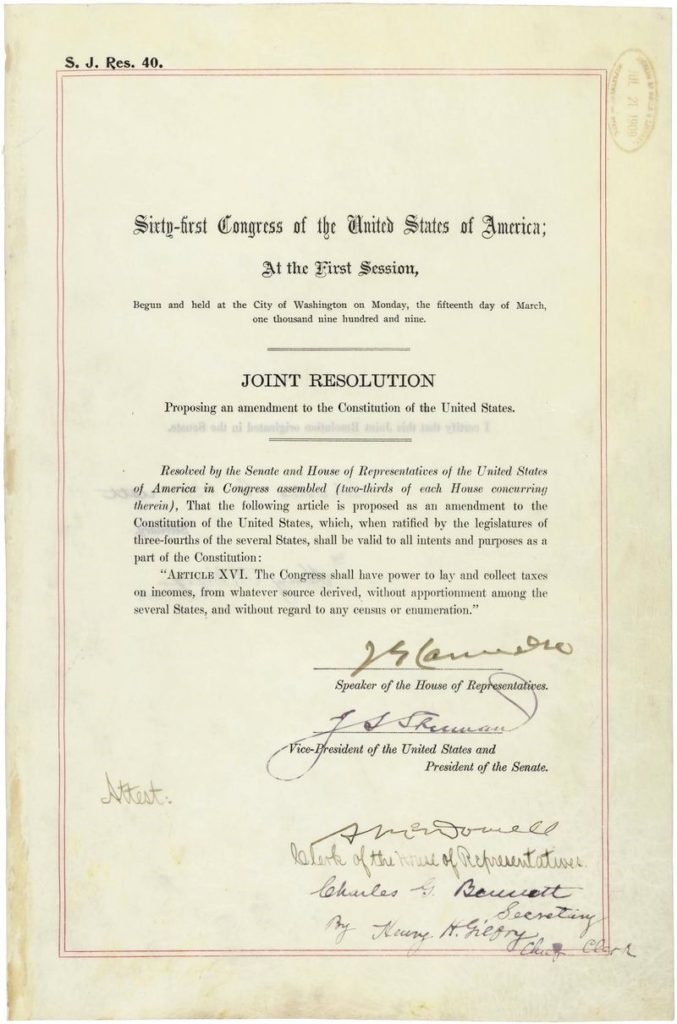

Benjamin Franklin sure nailed it when he said the only two certainties in the world are death and taxes. Paying income taxes has been a constant for almost 100 years for Americans, since the 16th Amendment to our Constitution was ratified in 1913. Back then, the top bracket was 7% and lowest bracket was 1%, and only 3% of the population was even subject to paying the "new" income tax!

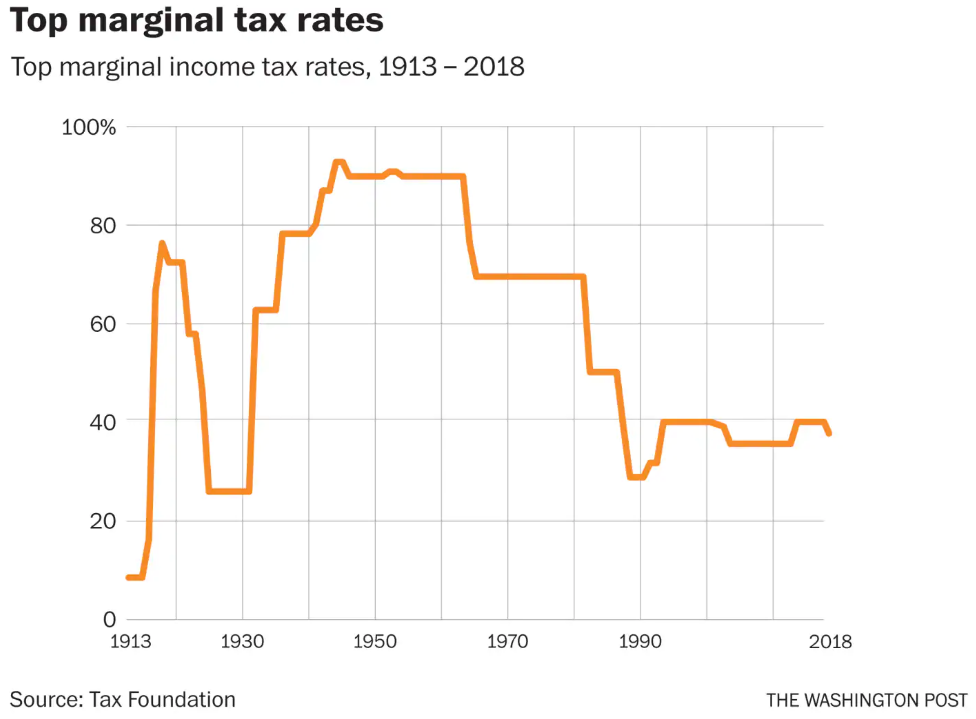

And while today's current federal tax rates are not quite as low as they were in 1913, they remain historically very attractive:

Independent of how much you may owe to Uncle Sam, virtually all of us are active participants in the "sport" of minimizing our obligation to the IRS (and here in California, the FTB as well), and the month of December is oftentimes a critical one when taking advantage of tax reduction opportunities before the calendar turns to the next tax year.

The Tax Cuts and Jobs Act (TCJA) of 2017, the most sweeping federal tax legislation since the Tax Reform Act of 1986, changed many aspects of tax planning, as lower overall personal income tax rates and a much larger standard deduction justified the reduction of the mortgage interest and state income tax deductions, the elimination of personal exemptions, and the severe limitation of itemized deductions. So, while the passage of the TCJA may have reduced the overall breadth of tax minimization strategies available to most taxpayers, it certainly allowed for the door to remain open for proactive, creative, and opportunistic taxpayers.

Between end-of-year IRA required minimum distributions (RMDs), cash and non-cash charitable giving strategies, Roth IRA conversion opportunities, mutual fund capital gains distributions, tax loss harvesting, IRA qualified charitable distributions (QCDs), "bunching" itemized deductions, maximizing end-of-year 401(k) contributions, as well as a myriad of other opportunities and strategies (please take a few minutes to click on the tiles found under the Towerpoint Wealth Tax Information section below), there will always be many potential tax minimization ideas worth considering, many of which come more into focus in December.

We encourage you to call or email us, and specifically, our own esteemed in-house CPA and Director of Tax (and Financial Planning), Steve Pitchford. Steve is an absolute maven when it comes to understanding and applying these tax reduction and minimization strategies and ideas, and because you are receiving this newsletter, you officially have objective and no-strings-attached access to him and his expertise!

In summary, understanding we can never completely eliminate our obligation to the IRS and other taxing authorities, at Towerpoint Wealth we continue to firmly believe in the importance of tax planning. And in the interests of reducing and minimizing the "necessary evil" of income taxes, we appreciate that proactive tax planning is a central component of any sound wealth management plan, and is a hugely important consideration when working to grow, and protect, one's net worth and assets.

TPW Running Strong!

26.2!!!!!!!

A HUGE congratulations to our Director of Research and Analytics, Nathan Billigmeier, who last weekend completed the "Fastest Course in the West" - the California International Marathon!!

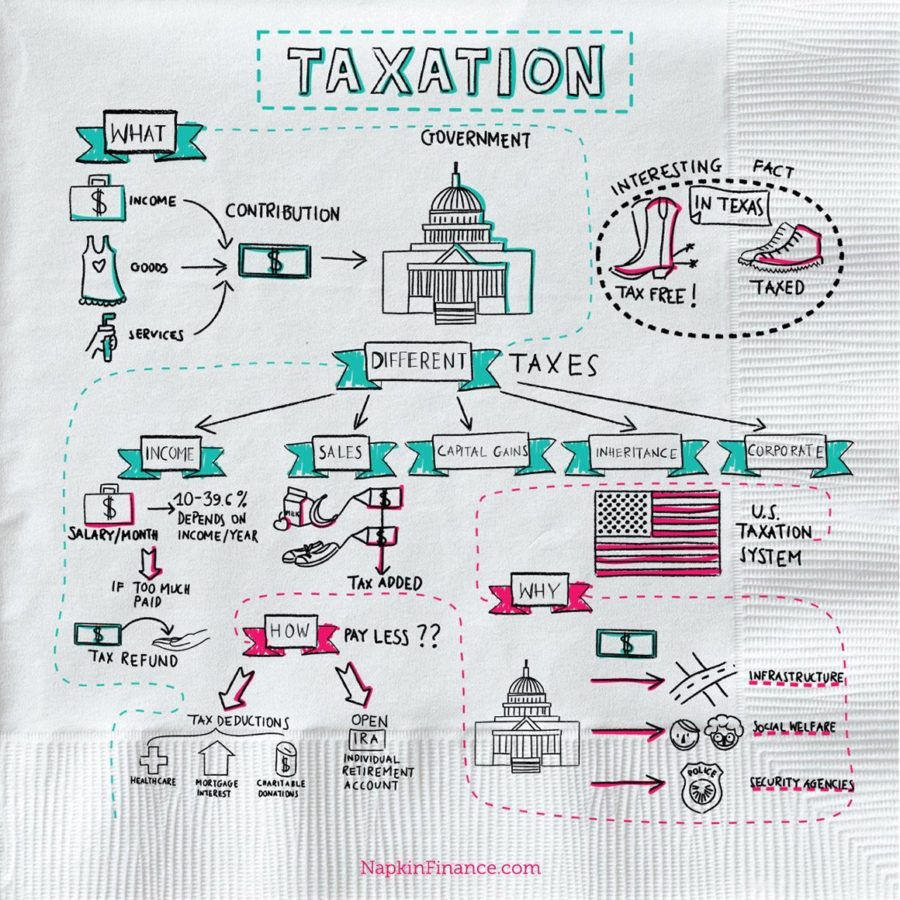

Credit to Napkin Finance. Click HERE for taxation details.

Trending Today

In addition to the discipline needed when engaging in end of year tax planning and/or distance running, a number of trending and notable events occurred over the past few weeks

- A US sailor opens fire at a Pearl Harbor shipyard days before the anniversary of the historic attack

- Scientists reveal a perfectly preserved 18,000-year-old puppy, discovered frozen in Russia

- Kamala Harris drops out of the race to become the Democratic presidential candidate nominee

- House Judiciary Committee approves two articles of impeachment against President Trump

- Russian athletes may be able to compete in 2020 Olympics, despite the The World Anti-Doping Agency handing Russia a four-year ban from top global sporting events, including the next summer and winter Olympics, as punishment for tampering with laboratory data.

- More developments have emerged in the examination into Boeing's 737 Max jet

- A speedy Brexit is on the agenda after big UK election win by Boris Johnson's Conservative Party

As always, we encourage you to reach out to us (info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely complicated place. We are here for you, and look forward to connecting with, helping, and being a direct, fully independent, and objective expert financial resource for you.

- Joseph, Jonathan, Lori, Nathan, Steve, Raquel, and James