Predicting the future is an intriguing and complex endeavor that has captivated human imagination throughout history.

And although the Simpsons have somehow consistently done it well, in real life it has also repeatedly been proven to be next to impossible to do. We strongly urge you to express humility about your ability, or anyone else’s, to accurately prognosticate.

“Nothing is sure tomorrow, nothing is sure next year, and nothing is ever sure, either in markets or in business forecasts, or in anything else.”

- Warren Buffett, at Berkshire Hathaway’s annual shareholder meeting, May 6, 2023

In the same vein, predicting the stock market is often regarded as a futile and risky endeavor, and there are several important reasons why relying on predictions can be extremely detrimental to investors. The stock market is a complex system influenced by numerous factors, including economic indicators, geopolitical events, and investor sentiment. Attempting to accurately forecast these variables is an incredibly challenging task, even for seasoned professionals. While there are many who prognosticate, the inherent uncertainty and volatility of each variable make it nearly impossible to consistently predict market movements with precision.

The reliance on predictions can also tempt investors who profess to be objective, and “longer-term,” to engage in speculative behavior, and can lead to irrational investment decisions. When individuals become fixated on trying to forecast the shorter-term movements of the market, they may overlook the longer-term fundamentals of a company or investment. This speculative mindset often results in impulsive buying or selling, driven by fear or greed, rather than by careful analysis of the underlying value of an investment. Such behavior can lead to market bubbles and crashes, as prices become detached from the true worth of the assets.

Additionally, the availability of prognostication in today’s 24/7 news cycle can create a false sense of security among investors. Some may rely heavily on what “the experts” have to say about the future, and to overvalue this forecasted information, and make investment decisions based on these predictions. However, predictions are inherently subjective, and are usually prone to biases. Even sophisticated predictive models are almost always flawed, as they are oftentimes built on historical data that may not accurately reflect unknown future market, political, and economic conditions. Listening to those who prognosticate, and blindly following predictions without considering other relevant factors, can expose investors to unnecessary risks and potential losses.

Here at Towerpoint Wealth, we believe that the inclination to predict the shorter-term future movements of the stock market undermines the core principles of longer-term wealth building, investing, and value creation. Successful investing is about being disciplined, having and objectively following a well-thought-out plan, and remaining objective during periods of market, economic, and political extremes. By focusing too much on predictions, investors may lose sight of the importance of patience, diversification, and confidence in a well-thought out financial and investment plan. We believe that those who remain committed to their investment thesis over time will be well-rewarded, as opposed to those who constantly chase and flip-flop based on short-term market fluctuations and well-articulated stories.

Relying on predictions to navigate the stock market is fraught with risks, oftentimes leading to poor investment decisions. The inherent complexity, uncertainty, and volatility of the market make accurate predictions a formidable challenge, at best. Furthermore, an overemphasis on predictions can promote speculative behavior, foster irrational decision-making, create false security, and detract from the fundamental principles of longer-term investing. Instead of fixating on predictions, investors are better off focusing on sound investment strategies, thorough research, and a disciplined approach to create value in their portfolios.

While the bashing of forecasting is easy, at Towerpoint Wealth we believe it remains necessary, as predicting the future easily sells in today’s media-driven culture. People are inherently drawn to “talking heads” who authoritatively prognosticate about what is going to happen in the market and the economy over the next day, week, quarter, or even year. Open any newspaper or turn on any financial news programming (and we use that term lightly), and it is easy to find an expert with a strong opinion about what lies around the corner.

Rather than listening to these “experts” prognosticate, we encourage you to instead take your cues from the true masters of wealth building:

- “We should be very cautious in what we expect of our prescience.”

- Howard Marks

- “I figure that I want to swim as well as I can against the tides. I’m not trying to predict the tides.”

- Charlie Munger

- “There is very little value added trying to predict where the market is going or guessing whether it’s overpriced or underpriced.”

- Bill Miller

And finally:

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients save and invest for retirement while minimizing taxes.

While attending the annual Professional Fiduciary Association of California (PFAC) conference in San Francisco last week, our Partner, Wealth Advisor, Jonathan LaTurner, and our Associate Wealth Advisor, Megan Miller, hosted a number of our professional fiduciary clients on a Foodie Adventures walking food tour of North Beach and Chinatown in San Francisco.

In addition to two full days of fiduciary education (here is the conference agenda), it looks like Jonathan and Megan did an excellent job of mixing a little pleasure with business while in SF!

Click HERE to message us with any questions or concerns you may have about your retirement right now.

Click the images below to get caught up on some of our most recent trending moments at Towerpoint Wealth you might have missed!

Retiring with two million dollars.

A 2020 survey from Schwab Retirement Plan Services found that the average worker expects to need roughly $1.9 million to retire comfortably. Is $2 million enough to retire? Is retiring with 2 million dollars a reasonable goal? There certainly are a myriad of moving parts involved in answering the question of whether retiring with $2 million is enough, and a number of things to consider.

Is $2 million enough to retire if you plan to live off interest alone? Is $2 million enough to retire if you plan to embark on expensive hobbies? Where you will live, and how? What will you need to cover health costs? These are just some of the financial complexities when you consider retirement.

Whatever the number you settle on as “enough,” click below to watch our latest educational video, and learn five specific steps you can take immediately to grow your net worth.

Click HERE to browse TPW’s library of other wealth-building and wealth-protecting educational videos.

Worried about whether you have enough set aside to retire? Check out our “Retiring with 2 Million Dollars” guide to learn five specific steps you can take immediately to work to grow your net worth!

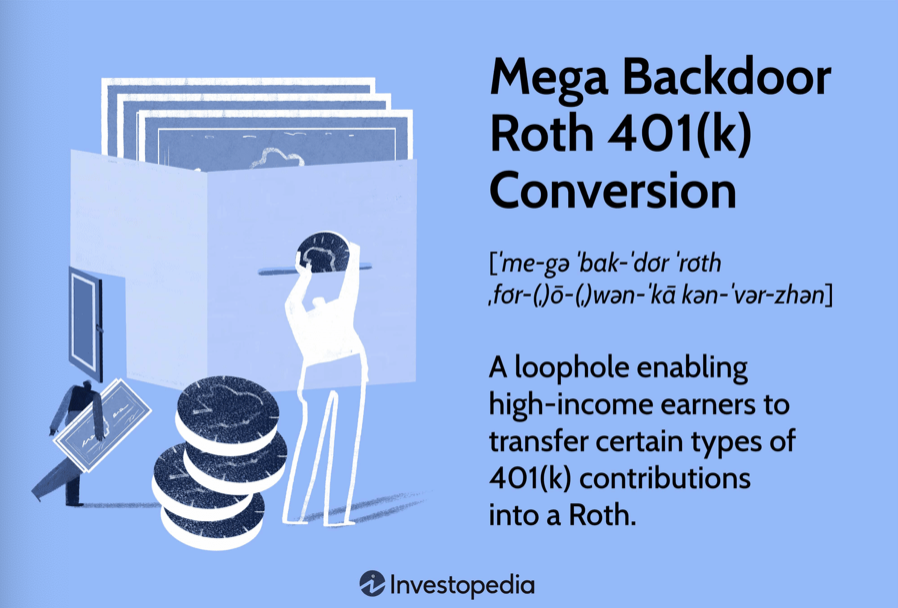

The MEGA Backdoor Roth 401(k)

How would you like to stash an extra $43,500 into a tax-free account?

The Mega Backdoor Roth 401(k) is a strategy that allows high-income earners to contribute significant amounts of after-tax money into their employer-sponsored retirement account, and then immediately convert those funds into a Roth 401(k). While traditional Roth IRA contributions are subject to earned income limits, the Mega Backdoor Roth 401(k) offers a way for individuals to surpass those limits and leverage the tax-free growth a Roth 401(k) provides. By utilizing this strategy, individuals can contribute significant sums of money beyond their standard 401(k) contribution limits, potentially turbocharging their retirement savings.

Here's how the Mega Backdoor Roth 401(k) works: First, max out your regular contributions (either “traditional” pre-tax or Roth) to your 401(k) account – for 2023, the ceiling is $22,500 if you are under age 50, or $30,000 if you are over age 50.

Then, if your employer allows it, you make additional after-tax contributions, beyond the aforementioned annual contribution limits. For 2023, the total combined 401(k) contribution limit, including this Mega Backdoor Roth 401(k) strategy, is $66,000, or $73,500 for individuals 50 years old and older. Once these extra after-tax contributions are made, the funds can then be immediately converted into a designated Roth 401(k) account via an in-plan conversion. This in-plan conversion allows these “extra” contributions to grow tax-free, and qualified withdrawals from Roth 401(k) accounts in retirement are also tax-free. It is important to note that the Mega Backdoor Roth 401(k) strategy may not be available in all employer-sponsored retirement plans, so it's crucial to check with your plan administrator to determine if this option is available to you.

We encourage you to contact us to discuss whether or not your 401(k) plan allows for Mega Backdoor Roth 401(k) contributions, and whether or not this strategy would be a worthwhile tool to utilize within your current wealth management plan.

Have questions or concerns about filing your 2022 tax return?

We welcome connecting with you and are happy to help. Click the banner below to message Steve Pitchford, Steve Pitchford, Certified Financial Planner.

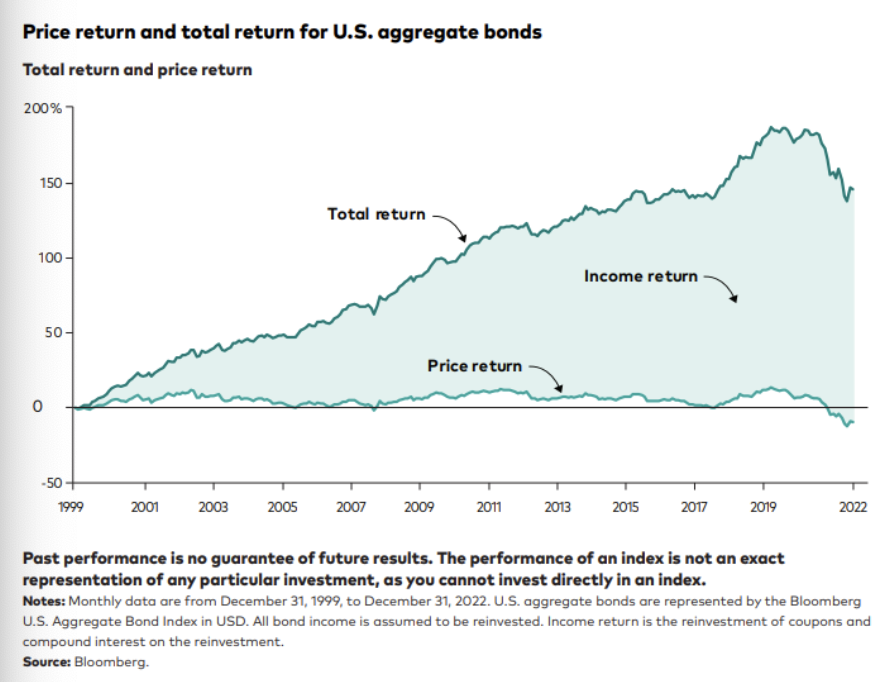

Bond INCOME Is Most Important!

The swift price declines in the bond market in 2022, caused primarily by aggressive increases in interest rates, were upsetting for some investors.

However, the longer-term performance of bond investments has come mostly from income return, not price return!

Put differently, bonds (and in particular, the income that they generate) are still a hugely important component of a properly-diversified portfolio, and higher interest rates can generally be *beneficial* for longer-term bond investors!

In light of how unsettled the economy and markets are, are you concerned or worried about the bonds in your portfolio, and/or the overall level of risk you are taking in your portfolio?

Looking for a Sacramento Wealth Advisor to discuss your circumstances? Message us today.

At Towerpoint Wealth, we help you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement. If you are worried about how the 2024 election could affect your financial future, we welcome talking further with you about your personal situation.

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X