If you had the option between a guaranteed $100 and a coin toss for $200, what would you pick?

Our bet is you’d pick the surefire cash, although the mathematical expectation is about the same either way ($100). The fear of potentially losing the guaranteed $100 outweighs the allure of possibly winning an additional $100, even though the expected value is the same.

This demonstrates a phenomenon known as loss aversion, describing our brain’s tendency to bias avoiding losses over securing equivalent gains. It’s not your fault that you fall into this trap – as human beings, we’re all wired this way! And even though our brains are hard-wired to avoid loss to PROTECT ourselves, it doesn’t mean we’re in a powerless position against our natural tendencies to avoid loss at the expense of a potential gain.

Loss aversion bias, a cornerstone concept in the field of behavioral finance, plays an important role in how many investors make financial decisions. It’s extremely important to understand the emotional side of investing and to be mindful of how it influences your investment preferences so that you can take steps to mitigate the negative effects of these inherent human biases and predisposed behaviors we all have.

Suboptimal investment decisions can be made if these built-in financial biases, such as the loss aversion bias, are not addressed. However, by better understanding your emotional predispositions, you can adopt a more objective, balanced, and rational approach to managing your portfolio and wealth. Having this understanding can improve your ability to achieve your longer-term financial goals, while giving you greater confidence and composure in your investment strategy.

What is the loss aversion bias, and why do we have it?

The loss aversion bias was first described by psychologists Daniel Kahneman and Amos Tversky in their development of the prospect theory. Prospect theory is a behavioral finance theory that describes how people make decisions when faced with risk.

In their experiments, Kahneman and Tversky determined that individuals consistently showed a preference for avoiding losses over acquiring gains… even when the potential gains far outweighed the risks.

Your brain does this for a reason. If you were out in the wild, surviving danger over seeking gains makes sense! Our brains, through evolution, have adapted a preference for safety and survival over acquiring gains, stemming from back when we were hunters and gatherers. This mechanism was formed to protect you.

Today, the loss aversion bias is not only shaped by individual psychology but also influenced by cultural and social factors. Culturally, societies often place a premium on security and stability, which adds to our pressure to avoid losses. There is a negative connotation associated with losing money, associating negative emotions and social reactions with risking loss. In many cultures, financial loss is even viewed as a personal failure.

Historical economic downturns also contribute to our instilled fear of financial loss. For instance, the Great Depression in the 1930s left a deep imprint on the following generations, creating a culture of risk aversion. More recent events like the 2008 financial crisis further elevated awareness of economic volatility and reinforced these tendencies.

With all of these factors at play in our brains, it’s no wonder we tend to prefer playing it safe!

How does the loss aversion bias affect investment decisions?

The loss aversion bias – the psychological phenomenon that makes us prefer avoiding loss over acquiring a gain – works the same way for investments. The pain of owning an investment that is (sometimes temporarily) declining in value is stronger than the desire to achieve a gain.

This bias can have profound implications for investors by affecting their risk tolerance, influencing objectivity in their decision-making processes, and negatively influencing their overall portfolio management choices.

One way the loss aversion bias manifests itself in investment behavior is by causing investors to stick to conservative investments as opposed to higher-growth but potentially riskier alternatives. This, in turn, can make investor portfolios tilt more toward capital preservation over growth.

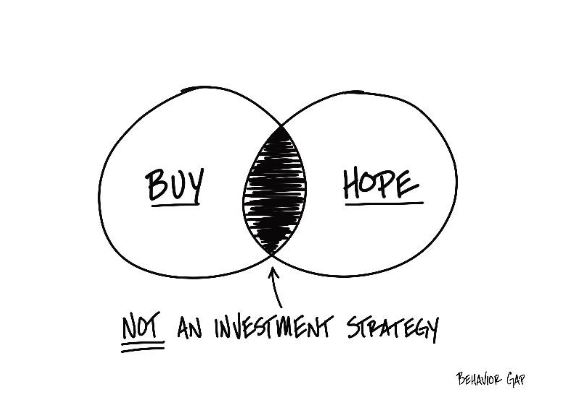

Another way loss aversion can affect investors is by making them reluctant to realize losses on their investments that have decreased in value. This causes the disposition effect, making investors hold onto losing investments in hopes of recovering their return and avoiding the loss.

The disposition effect leads investors to leave their investments tied up in underperforming assets for too long of a period instead of reallocating them to potentially more appropriate or higher-performing options.

Loss aversion also influences decision-making during market downturns or periods of volatility. The heightened emotional response to losses can cause investors to make irrational decisions when markets are facing difficulty, such as panic-selling or abandoning their disciplined investment strategy altogether. This reactive behavior often results in selling investment assets at lower prices to “stop the bleeding,” and locking in losses.

Beyond that, the loss aversion bias can deter investors from taking calculated risks in their investment decisions that could yield higher returns. This can decrease portfolio diversification and cause investors to lean toward options with lower, but more stable, returns.

How do we lessen the effects of the loss aversion bias?

For investors looking to make rational, objective, and effective investment decisions, understanding how to mitigate the negative effects of the loss aversion bias is essential. There are a few strategies that can help investors navigate their decisions with this psychological tendency in mind:

- Self-awareness! By learning about the loss aversion bias – like you’re doing right now – and better understanding how it affects your investment decisions, you can recognize when you’re being driven by fear. Learning about and recognizing these financial behaviors can empower you to make your decisions based on disciplined and rational analysis.

- Adopt a longer-term perspective to investing. Shifting your focus from the short-term gains and losses to the results in the longer-term can help you resist the urge to make impulsive investment decisions when things are unsettled, or aren’t performing to your expectations.

- Diversify your portfolio. Diversification across different asset classes, industries, and regions can help mitigate the impact of individual losses on your overall portfolio. Spreading the risk across different investments helps to balance out the potentially temporary underperformance of certain assets, and helps investors feel more secure and avoid reactive decision-making.

- Have a risk management strategy. Creating a strategy with your advisor that aligns with your risk tolerance, and that includes clear guidelines for reallocation and rebalancing can minimize emotional decision-making in your investments. Partnering with your advisor to develop such a strategy promotes disciplined and rational investment practices.

- Consult with your trusted advisor. Having conversations and building your investment strategies with a financial advisor who understands behavioral finance, and can provide a disciplined and objective direction, can be a vital tool in balancing your emotions with your investment strategy.

How can a financial advisor help you navigate the loss aversion bias?

Having a trusted financial advisor to help you manage the emotions behind your financial decisions can give you a powerful advantage against your brain’s hard-wired tendencies. Financial advisors who are legal fiduciaries, and who have the expertise in objective analysis and behavioral finance can help steer clients away from making investment mistakes due to their loss aversion bias.

Strategic guidance and personalized planning

By offering strategic guidance, advisors work to ensure that investment decisions are based on rational evaluation, rather than fear-induced reactions. Armed with the experience of a trusted professional, you can create a structured approach to your investments that leaves no room for your emotions to take the wheel.

Advisors who are legally bound to the fiduciary standard are there to make decisions that are 100% in your best interest. Their advice, counsel, planning, and decisions must be aimed solely at enhancing your financial well-being, a commitment that adds extra security to your financial strategies and peace of mind. Knowing that your advisor is legally and ethically bound to ensure your best interests can add enormous confidence, which aids in your battles with fears and cognitive biases.

Educating on emotions

Another way financial advisors can help you combat your loss aversion bias and its effect on your investment decisions is by educating you on how your emotions are at play. You don’t just go to your advisor to have someone execute a trade for you; you’re there for objective counsel, planning, and advice, even if it makes you uncomfortable. A trusted advisor can help walk you through your decision-making process with a firm understanding of what’s going on behind the scenes, empowering you to fight back and remain disciplined.

Regular review

When you work with a financial advisor in a longer-term capacity, they likely don’t have a set-it-and-forget-it approach. Your life, and the economy and financial markets, are certainly not static, and investment plans are much more successful when your advisor is consistently monitoring and strategically rebalancing your portfolio. Advisors conduct periodic reviews of portfolio performance and market conditions to ensure that investment plans remain aligned with your evolving goals and risk profiles.

This proactive management helps mitigate the impact of the loss aversion bias by keeping the focus on long-term financial goals. Advisors provide the necessary support and reassurance during inevitable but almost always temporary market downturns, encouraging clients to stay disciplined and avoid panic-driven decisions that could lead to substantial losses.

Buffer for your bias

Finally, financial advisors can help you manage your loss aversion bias and minimize the negative effects of the loss aversion bias on your portfolio by acting as a buffer between you and your reactive decisions. It’s much easier to make poor investment decisions out of fear without the added level of accountability and support that a trusted advisor can provide.

Regular consultations, conversations, and check-ins with your trusted advisor can ensure that you remain committed to your financial plans and stay on track to meet your goals.

Don’t pay the price of panic

Loss aversion, a key behavioral finance concept, is a powerful psychological bias that can significantly impact investment decisions and financial outcomes. Your brain is programmed through evolution to value avoiding loss over acquiring equivalent gains. This, in turn, affects how you make investment decisions.

Thanks to this cognitive bias, investors are more likely to stick with conservative options over investments with more growth potential. Over time, this can significantly reduce the return you get from your assets.

The loss aversion bias can also lead to panic-selling in times of economic and market uncertainty (realizing losses that may have the potential to recover) or, conversely, to hold on to underperforming investments to avoid realizing losses.

However, you are not powerless against this bias as an investor. Being aware of your brain’s tendencies is the first step to controlling its effect on you. By understanding the underlying factors that drive loss aversion, and using strategies to mitigate its effects, investors can opt for more rational and informed choices.

Want to learn more about financial planning and stay up to date on what’s happening in the wealth management world? Check out our YouTube Channel for educational content on all things finance!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity. We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on YouTube

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on X

Click HERE to follow TPW Podcast : A Wealth of Knowledge