“It’s not so much who wears the pants, but how much money is in the pockets.”

Money and marriage often dance together in a delicate waltz of financial decisions and shared goals. For better or worse, money plays a significant role in the dynamics of a marital relationship. From (sometimes) merging bank accounts and setting joint budgets to navigating financial disagreements, couples must learn to communicate openly and honestly about their financial attitudes and priorities.

Money can either be a source of stress and conflict, or an empowering tool for building a solid future together. By working as a team and aligning their financial values, couples can unlock the true potential of their partnership, achieving not only financial security but also a deeper understanding and connection with each other. Ultimately, finding a harmonious balance between love and money becomes the key to a successful and fulfilling marriage.

While money and marriage can be complicated, there are many financial benefits of marriage that are undeniable, and can help with the decision to tie the knot. For some, it's like having a built-in financial advisor and budgeting buddy, except they're also your forever Netflix partner. Imagine splitting the bills, sharing expenses, enjoying two incomes, and budgeting together – minus Monty Hall, it's like a never-ending game of "Let's Make a (Financial) Deal!"

While the financial benefits of marriage should probably not be the number one priority when deciding whether to tie the knot, if the money and marriage connection is of interest to you, below you will find some of the key economic advantages to getting hitched!

1. Two incomes, shared cost

Combining two incomes often leads to increased financial security and a higher standard of living. With two individuals earning an income, there is more money available to cover essential expenses, build savings, and invest for the future. This can make it easier for couples to achieve their financial goals, such as buying a home, paying off debt, or saving for retirement.

In addition to combined incomes, the benefits of shared costs in a marriage extend far beyond just splitting expenses. Sharing costs as a married couple can lead to a more efficient and effective use of resources, fostering financial stability and security. It also enables spouses to pool their resources, which can lead to increased purchasing power and potential savings on everyday expenses, from groceries to utility bills. Moreover, sharing costs can alleviate financial stress and reduce the burden of individual financial responsibilities, promoting a sense of teamwork and mutual support within the marriage. Ultimately, when considering money and marriage and by sharing costs, couples can build a stronger financial foundation and navigate life's financial challenges as a united front, reinforcing the bond that comes with being partners in both love and money. However, many of the cost benefits of tying the knot become moot when kids enter the picture!

2. Tax Benefits

Marriage also provides opportunities for tax benefits, as mentioned in greater detail in the TPW Taxes section below. Compared to single filers, couples filing jointly can potentially lower their overall tax liability and access various tax credits and deductions that might not be available to single individuals. This can result in significant savings.

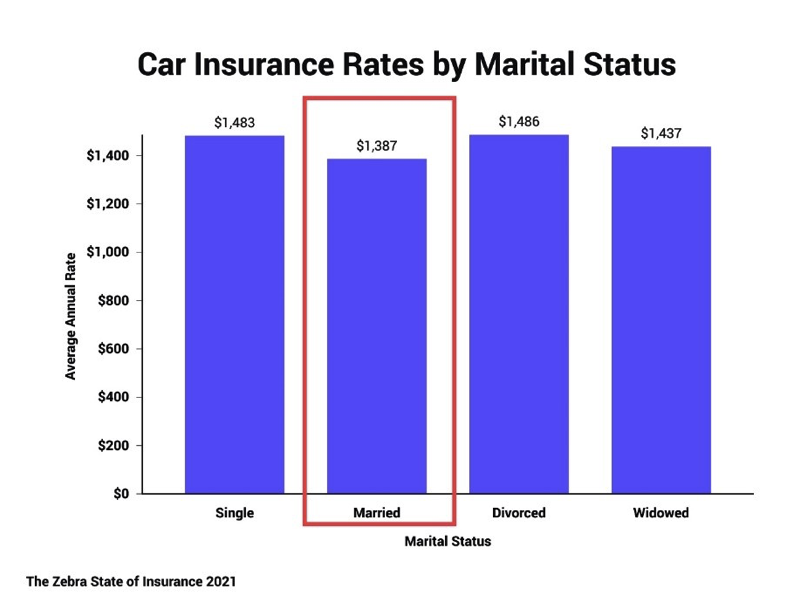

3. Insurance

When you’re married, health insurance and employee benefits can be more advantageous. Many employers offer benefits packages that cover spouses, which can lead to better healthcare coverage and reduced medical expenses. This can be particularly valuable if one spouse's employer provides superior health insurance options compared to the other's. Additionally, married couples oftentimes qualify for lower premiums on automobile, homeowners, and other insurance policies, as rates can go down when you get married. This is because insurance companies consider married couples more financially stable and risk-averse.

4. Access to credit

It can be more cost-effective to obtain credit when you are married, thanks to the combined financial strength of the couple. Lenders often take into account both spouses' incomes and credit histories when evaluating credit applications, which can lead to more favorable terms and lower interest rates. With a higher combined income, the couple may qualify for larger credit limits and better loan terms, such as lower APRs on credit cards or mortgages. Additionally, if one spouse has a stronger credit score than the other, their financial credibility can positively impact the overall creditworthiness of the application. This can translate into more competitive offers and increased access to credit options, ultimately making borrowing more affordable for the couple as they embark on shared financial endeavors.

However, it is important to note that when it comes to money and marriage, getting married doesn’t impact your individual credit score, and credit reports are not combined.

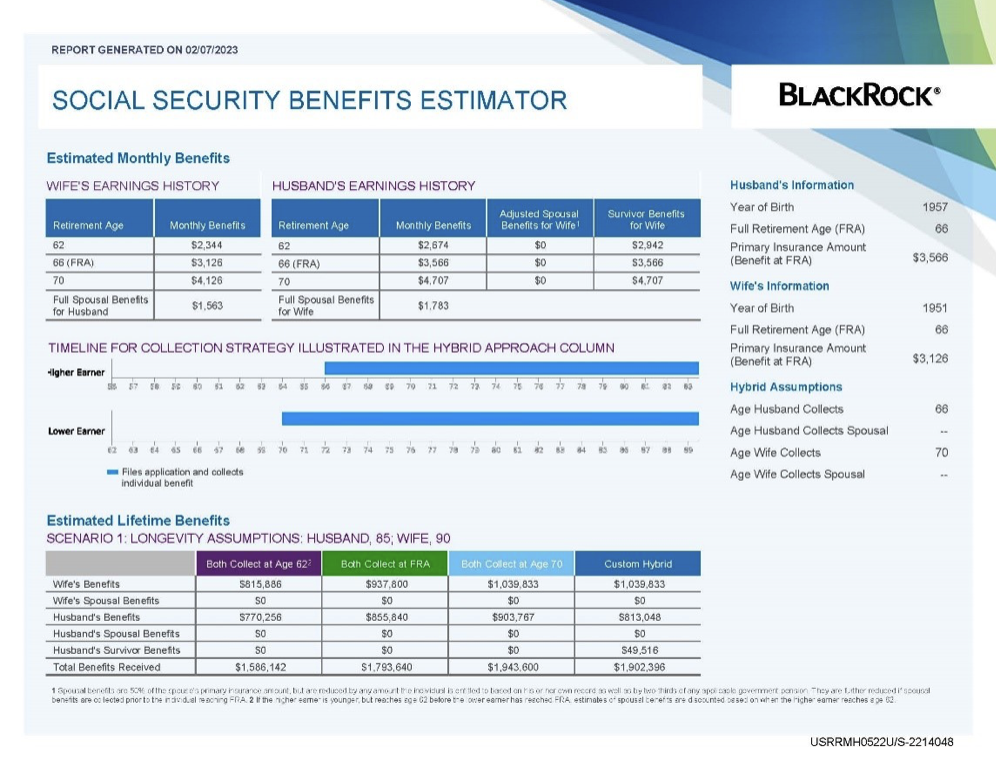

5. Social Security

Social Security benefits can be more lucrative when you are married, thanks to certain spousal benefits and strategies. For instance, a married individual may be eligible to receive a spousal benefit, which allows them to claim Social Security based on their spouse's work record. This can be especially useful if one spouse has a significantly higher lifetime earnings history. Additionally, married couples can strategically coordinate their claiming strategies to maximize their combined benefits. For example, the higher-earning spouse can delay claiming their Social Security, allowing their benefit to grow over time, while the lower-earning spouse can start claiming earlier, providing some income for the couple. By leveraging these spousal benefit options and optimizing their claiming strategies, married couples can enhance their overall Social Security income and ensure a more financially secure retirement together.

Click the image below if you would like us to assemble a fully-customized andcomplementary Social Security Optimization Analysis for you and your spouse.

To be clear, love comes first! However, when it comes to money and marriage, the financial benefits of taking the plunge can be substantial. From the potential for lower tax liability and enhanced access to tax credits, to increased earning potential and improved savings opportunities, marriage can provide a solid foundation for a couple's financial well-being. Sharing costs and combining resources can lead to a more efficient use of income, empowering couples to pursue shared financial goals with greater ease. Moreover, the ability to strategize and optimize benefits, such as Social Security and retirement accounts, further strengthens the financial advantages of being married. While every individual situation is unique, the potential for financial stability, increased security, and shared prosperity makes marriage an appealing option for many couples seeking to build a brighter financial future.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients save and invest for retirement while minimizing taxes.

This past Tuesday, most of the Towerpoint Wealth team participated in The Cathedral of the Blessed Sacrament’s Brown Bag Lunch Program in downtown Sacramento. In response to the growing numbers of downtown homeless needing food, nourishment, and kind words, the TPW team prepared and then handed out nutritious brown bag lunches (consisting of a protein, a fruit, a healthy carb, and a bottle of water) to feed approximately 150 homeless men and women. Click on the video and watch a small recap of our morning.

Click the images below to get caught up on some of our most recent trending moments at Towerpoint Wealth you might have missed!

What is a Fiduciary Financial Advisor?

A fiduciary financial advisor is a trusted professional who operates with the utmost integrity and puts their clients' best interests above their own. Unlike other financial advisors, an advisor with a fiduciary duty has a legal and ethical obligation to act solely in the best interest of their clients, ensuring that any advice or recommendations provided are completely unbiased and aligned with the client's personal and financial goals and needs. The highest standard of care in the wealth management industry, it instills confidence in clients, knowing that their advisor is committed (and legally obligated) to transparency, honesty, and prudent financial practices.

Are you working with or considering working with a broker, who is only obligated to the suitability standard?If so, it is essential to understand how the fiduciary duty that a fiduciary financial advisor has to their clients is different.

Click the image below to watch an excellent educational video, designed to help you learn more!

Click HERE to browse TPW’s library of other wealth-building and wealth-protecting educational videos.

Marriage and Uncle Sam

Married couples who choose to file their taxes jointly can enjoy several significant tax benefits. One of the primary advantages is the potential to lower their overall tax burden. When filing jointly, couples can often take advantage of more advantageous tax brackets, which means they may pay a lower percentage of their income in taxes compared to filing separately. Additionally, the standard deduction, as well as certain tax credits and deductions (such as the Earned Income Tax Credit (EITC) and the Child Tax Credit), can be more accessible or higher in amount for couples who file jointly. These benefits can directly reduce the amount of tax owed or result in a larger tax refund. Want proof? See the 2023 IRS income tax brackets found below:

Another key benefit of married filing jointly is the ability to contribute to Individual Retirement Accounts (IRAs) and Roth IRAs, even if one spouse does not have earned income. Funding a "spousal IRA" allows a working spouse to contribute to a non-working spouse's retirement account. This can be an effective strategy to boost overall retirement savings and potentially reduce the couple's taxable income. By pooling their resources and filing jointly, married couples can often optimize their tax situation and maximize the financial advantages offered by the tax code. However, it's essential for couples to carefully evaluate their specific financial situation and consult with a tax professional to determine the most beneficial filing status for their needs.

View our 2023 Tax Reference Guide, and download an excellent resource intended to help you stay on top of and organized with your tax planning this year!

Have questions or concerns about filing your 2022 tax return?

We welcome connecting with you and are happy to help. Click the banner below to message Steve Pitchford, Steve Pitchford, Certified Financial Planner.

Thanks to Chartr for the caption and the chart!

Data from Pew Research reveals that an astonishing 25% of 40 year olds in the US have never been married, marking a record high share. In 2010, the corresponding figure was 20%, and if we go back to 1980, just 6% of 40 year olds had yet to tie the knot.

The data fits with the longer-term trend in marriage — people have been getting married at a lower rate and generally later in their lives. Indeed, the typical age for men to say "I do" was just over 30, while women typically married a few months after their 28th birthday, according to the US Census Bureau. Both these ages have increased by around 5 years since the turn of the century. In 2000 the median age for men and women to get married was 26.8 and 25.1, respectively, and if you go back to the 1950s, women were typically getting married just after they turned 20.

In light of how unsettled the economy and markets are, are you concerned or worried about

the bonds in your portfolio, and/or the overall level of risk you are taking in your portfolio? Message us to discuss your circumstances.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Worried about whether you have enough set aside to retire? Check out our “Retiring with 2 Million Dollars” guide to learn five specific steps you can take immediately to work to grow your net worth!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast