What We Know about the $740 Billion Inflation Reduction Act

The Inflation Reduction Act of 2022 (IRA) passed the Senate on a 51-50 party-line vote on Sunday (with Vice President Kamala Harris casting the tiebreaking vote), and is expected to get a final vote in the House today. And while it is a far cry from President Biden’s original and wildly ambitious $3.5 trillion Build Back Better Act, this $740 billion spending package marks a significant legislative victory for the President and for Democrats.

The IRA legislation is an excellent representation of today’s polarized and partisan political landscape, and a microcosm of the “fact or fiction?” question surrounding the integrity of and spin found within today’s journalism.

- Speaker of the House, Nancy Pelosi: “It’s a great bill. It’s historic.

- House Minority Leader Kevin McCarthy: “They’ll spend more money, which brought us into this problem.”

Putting aside whether we agree with the intent and myriad of provisions found within the bill, we can all acknowledge it is broad-based, comprehensive, and confusing. And while inflation reduction remains a key point of contention surrounding the legislation, our focus is to pointedly address the question: “What’s in it for you, our clients?”

First, what is not in it for you.

1. Direct payments or checks in the mail.

2. A “clean vehicle” tax credit of up to $7,500 (see below) if the vehicle you purchase does not meet all of the requirements for electricity power and mineral or battery components.

-This credit would be cut or eliminated if your vehicle is not sold by a “qualified manufacturer” and/or the final assembly did not take place in North America.

3. A tax (which was removed from the final version of the legislation) on carried interest payments to private equity and hedge fund managers.

Next, what is in it for you:

1. If you are a Medicare beneficiary, your yearly out-of-pocket Part D drug expenses capped at $2,000/year (starting in 2025).

Today, there is no cap.

2. Also for Medicare beneficiaries, a $35 monthly cap on the cost of covered insulin products (starting in 2023).

According to a Health Affairs study published just last month, spending on insulin has reached catastrophic levels.

3. An extension of a key Affordable Care Act (Obamacare) subsidy that reduces annual medical insurance premiums by $800 through 2025.

- This was set to expire this year, and makes health insurance more affordable for Americans who buy it on their own.

4. Potentially less expensive prescriptions. For the first time, Medicare could, beginning in 2026, negotiate bulk discounts with drug companies for pharmaceuticals (something many private insurers currently do).

- This is getting publicity because policymakers have been trying for years to give Medicare managers some ability to bargain with pharmaceutical companies. However, these new negotiating powers are only applicable for 10 drugs per year.

5. A new “clean vehicle” tax credit of up to $7,500.

This credit applies and is earned as follows:

- New clean automobiles that cost up to $55,000.

- New trucks, vans, and SUVs that cost up to $80,000.

- You must earn less than $150,000 (single) or $300,000 (married filing jointly).

6. A used “clean vehicle” tax credit of up to $4,000.

This credit applies and is earned as follows:

- Used clean vehicles (two years old or older) that sell for $25,000 or less, the credit is up to $4,000.

7. Energy-efficient home credits.

- The credit for installing qualified goods (such as Energy Star products including solar electric, solar water heating, fuel cell, small wind energy and geothermal heat pumps) at non-business properties increases from 10% to 30%.

- A lifetime cap on these credits is replaced with a $1,200 annual credit ceiling ($600 for energy-efficient windows, $500 for energy-efficient doors).

- A $2,000 energy-efficient home credit would be offered for biomass stoves and heat pumps.

- Existing credits would also be enhanced to cover home energy audits (up to $150) and electrical panel upgrades (up to $600).

Last, how is it paid for?

1. New taxes.

- A new 1% levy on stock buybacks by publicly-traded companies (will this be increased in the future?).

- A new 15% alternative minimum tax on larger corporations (will this be immediately passed on to consumers and stockholders?), some of which report significant profits, but pay little or even nothing due to credits or deductions.

2. Collection of unpaid taxes.

- The IRS will be adding thousands of new agents to go after tax cheats, increasing the need for labor (but where will these new employees come from, understanding the tight labor market?).

- This is expected to substantially increase the audit rate on those earning more than $400,000 annually.

3. Drug savings / price controls.

- As discussed above.

Many have asked “Where is the inflation reduction?” that this legislation claims to produce. According to initial estimates, the measure would raise a total of $739B in revenue, and spend a total of $433B, reducing the budget deficit (and therefore, inflation) by roughly $300B over a decade.

The non-partisan Congressional Budget Office also found that the package would reduce the deficit by about $102B over the next 10 years, and would be in-line with the deficit reductions claimed by Sens. Chuck Schumer and Joe Manchin if revenue from tax enforcement was included in the calculations.

It is also important to understand that if Republicans end up regaining control of the Senate in January 2023, they might be able to zero-out any Inflation Reduction Act taxes, tax break amounts, or other Medicare benefits change amounts in future must-pass budget or spending packages.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients build and protect their net worth.

The entire Towerpoint Wealth Team came out on Community Volunteer Day to lend a hand to the American River Parkway Foundation program to clean up trash along Sacramento’s urban gem.

Spanning 23 miles and covering 4,800 acres, the Parkway is a mecca for outdoor enthusiasts and those looking to refresh themselves.

In 2021, more than 200 fires burned over 15% of the parkway. The Parkway in Peril program created by the Foundation aims to mitigate fire risk by cleaning up trash. Volunteers play an essential role in conservation of the parkway.

Guided by Alex Watson, the TPW team hauled out ~ 1,400 lbs. of old bicycles, couches, and what felt like a ton of plastic waste in sweltering temperatures.

Click the thumbnail below to watch an inspiring video where you can see the TPW team all hard at work helping preserve this Sacramento treasure!

The Towerpoint Wealth Investment Committee (TPWIC) is working hard for our clients every day, evaluating our model portfolios and debating new ideas, investments, and tactical economic trends.

The ultimate goal? Helping YOU to remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement. Click below to watch a video “short” of TPWIC’s most recent meeting!

What else is happening with the Towerpoint Wealth family?

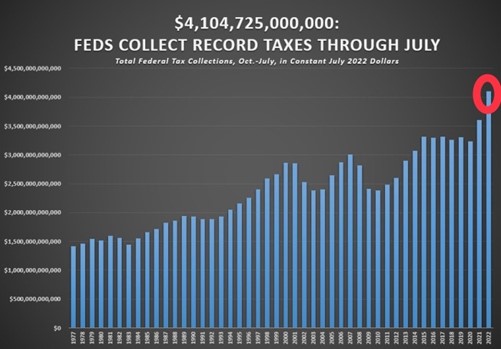

$4,104,725,000,000!

Thanks in part to an ongoing recovery from the pandemic, spiking inflation, and Americans who are receiving higher wages than ever before, tax receipts for the IRS have broken a record.

According to the monthly US Treasury statement, the federal government collected more than four trillion dollars in total taxes in the first ten months of fiscal 2022 (October, 2021 – July, 2022), up almost 14% from what the US Treasury collected in taxes in the first ten months of fiscal 2021 and setting a new record.

However, don’t forget about federal government outlays, as we spent $4,830,844,000,000 in the same time period, resulting in a deficit of more than $726 billion.

Are you generally happy with the federal government’s budgeting and spending, or do you think there is room for improvement?

Useful and interesting content we read the past two weeks:

1. Yes, China Would Go To War Over Taiwan – The Cato Institute – 8.2.2022

U.S. officials in four administrations disregarded Moscow’s increasingly pointed warnings, and we are now witnessing the tragic results in Ukraine. It is imperative that Washington not make the same blunder with respect to China’s warnings about Taiwan.

China is as likely to use military force to defend a vital national security interest as Russia was to repel U.S. meddling in Ukraine. Washington needs to take the PRC’s escalating warnings about outside powers interfering in Taiwan much more seriously than it has to this point.

2. Trump’s Bond with GOP Deepens After Primary Wins, FBI Search – AP News – 8.10.2022

This week’s rapid developments have crystalized the former president’s singular status atop a party he has spent the past seven years breaking down and rebuilding in his image. Facing mounting legal vulnerabilities and considering another presidential run, he needs support from the party to maintain his political career.

But, whether they like it or not, many in the party also need Trump, whose endorsement has proven crucial for those seeking to advance to the November ballot.

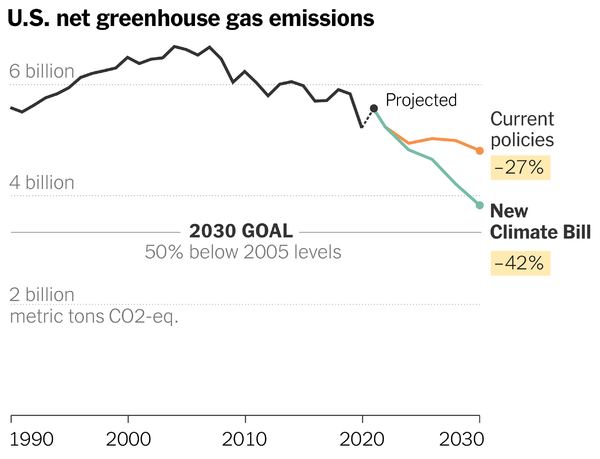

3. Electric Cars Too Costly For Many, Even With Aid in Climate Bill – The NY Times – 8.9.2022

Battery-powered vehicles are considered essential to the fight against climate change, but most models are aimed at the affluent.

And experts say broader steps are needed to make electric cars more affordable and to get enough of them on the road to put a serious dent in greenhouse gas emissions.

Feeling overwhelmed by the responsibility of discerning financial noise from financial information. Are you unsure of how to utilize and leverage financial information to your advantage?

Not everyone handles market volatility the same way. If you happen to be speaking with someone who is concerned about their investments or advisor, we welcome talking with them.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph Eschleman, Jonathan, Steve, Lori, Nathan, Michelle, and Luis

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity.

We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on Twitter