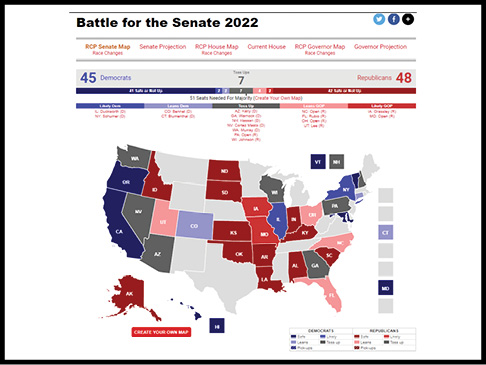

Many investors are asking: “If the (insert: REPUBLICANS or DEMOCRATS) win the 2022 midterm election, should I change my investment strategy?”

Be it a bear, a bull, a donkey, or an elephant, investors tend to place a significantly greater amount of attention on political outcomes than is necessary, at least when it comes to their investment portfolios.

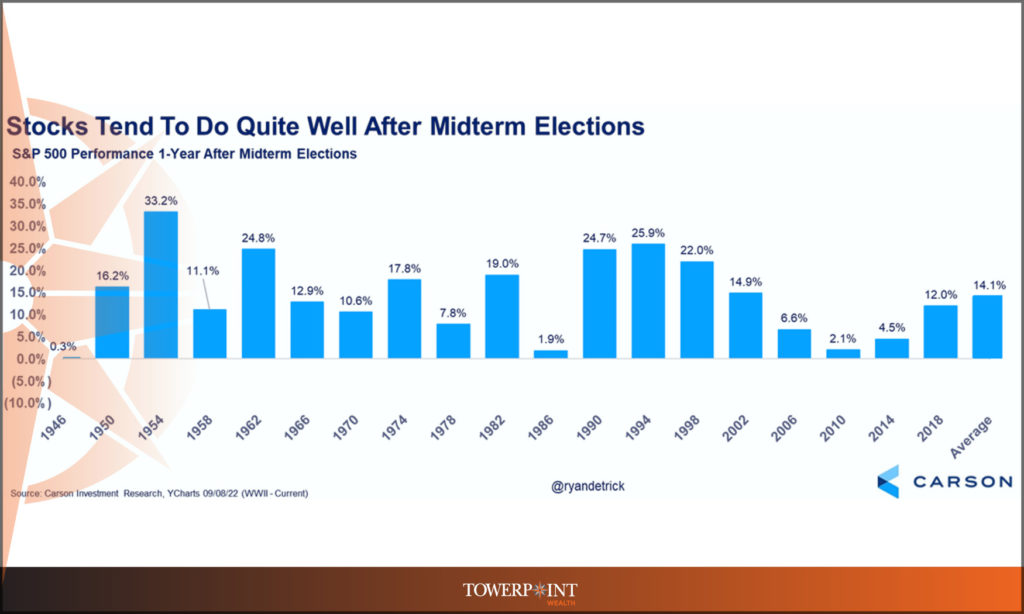

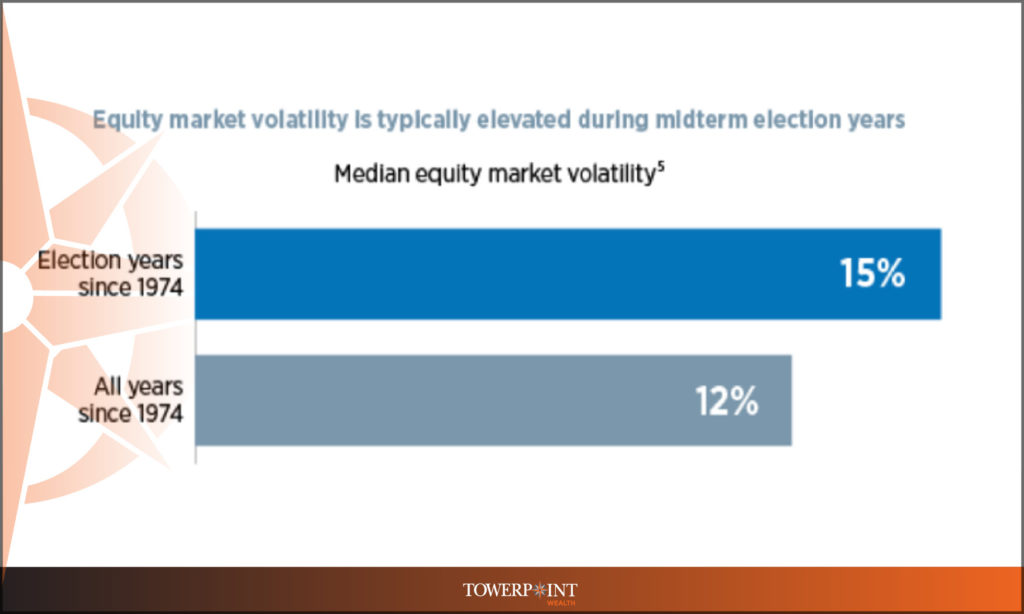

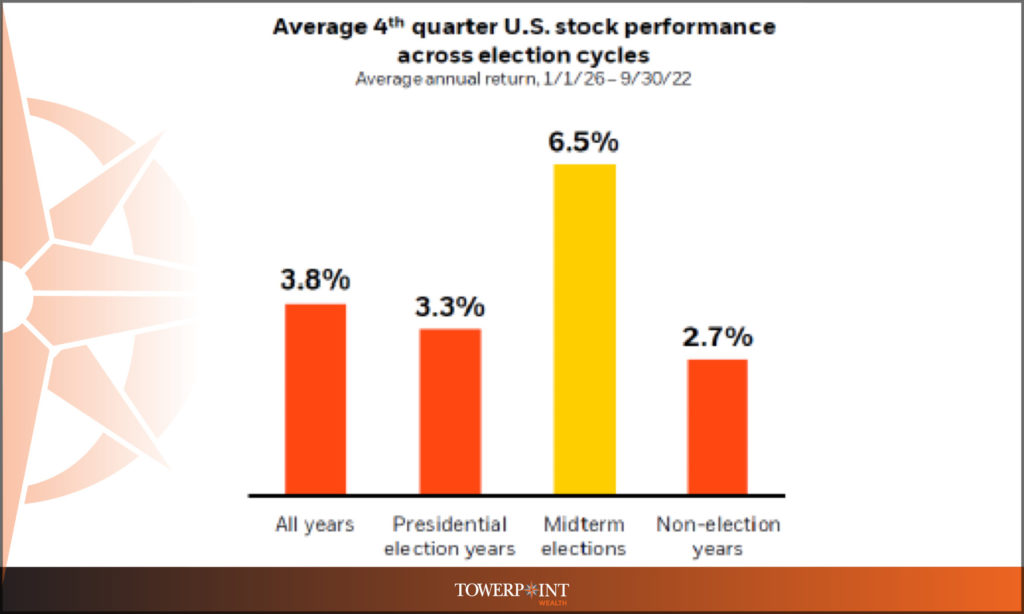

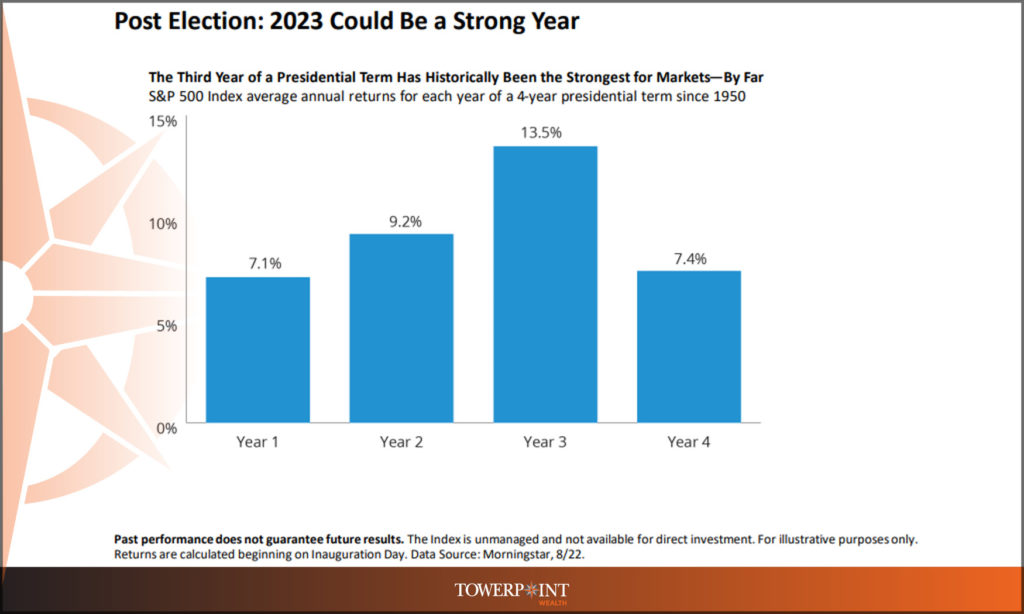

Given the relative stability of our economic system, US history has shown that there is not a “preferred” political party for the overall stock market. While electoral developments at the federal level may create shorter-term volatility, who ultimately sits in Congress matters less than you think. And regardless of which party wins the House and Senate next week, the historical performance of the stock market after the 2022 midterm election may end up being very good.

At Towerpoint Wealth, we believe that good, well-run, and profitable companies will almost always remain good, well-run, profitable companies, regardless of which way the political winds are blowing. Regardless of whether the White House and Congress are unified or divided, the stock market tends to march higher over time. However, what is also true is that volatility tends to elevate during midterm election years, even if temporarily.

Sound like 2022 so far? Understanding this data, we believe that 2023 can’t get here fast enough!

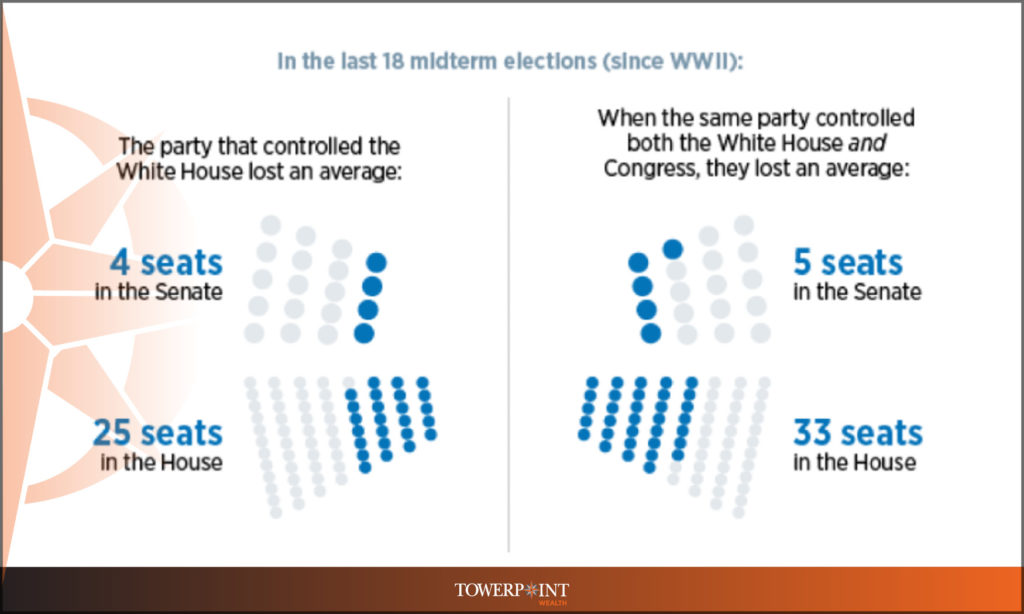

Putting aside the market and investment implications of the upcoming 2022 midterm election, below is what has happened historically in Congress.

Here at Towerpoint Wealth, we witness it firsthand every two years – a cross-section of clients who lean Democrat tend to become more worried, uneasy, and concerned about their investments after a Republican win, and conversely, certain Republican clients have the exact same feelings after a Democrat victory. Either way, we recognize it can be difficult to be fully rational during this period of heightened political discourse and rhetoric.

We have seen that politics can oftentimes distract an investor from focusing on and ultimately achieving longer-term financial goals. While there is no question that government policy can have an impact on economic growth, and can also affect specific stocks, bonds, and sectors, for most long-term investors, it makes more sense to focus on economic and market fundamentals rather than the upcoming midterm election poll results.

Two important reasons we have this viewpoint:

- Investment returns over the longer-term correlate directly to the economic cycle, which has less to do with who's in office as compared to other factors that drive growth. Many economic and technological trends are much larger than politics.

- Economic policy is difficult to evaluate and often works with a lag. For instance, while corporate tax cuts may result in a short-term jump in the stock market, the true economic benefits occur over years and decades.

There will ALWAYS be pundits and “talking heads” on both sides of the aisle, predicting doom and gloom based on the other party's proposals. And while there are policies that can promote long-term investment spending and job growth, the record shows that it's incredibly difficult to accurately predict the shorter-term economic impact of any particular proposal.

It is paramount to focus on fundamentals in an uncertain environment like the one we are in today. The Towerpoint Wealth Investment Committee anticipates that the economic and market conditions that have fueled the volatility we have experienced this year will remain in place for some time after the last votes are counted, and the “noise” from the 2022 midterm elections subsides. However, we encourage you to not get too low, as the 4th quarter of 2022, and 2023 as a whole (the third year of President Biden’s term), could and probably will be quite different than what has happened so far in 2022, as evidenced by the two charts below.

Have questions or concerns? Let’s talk.

Let’s talk – message us to schedule a no-strings-attached initial conversation.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients build and protect their net worth

The Towerpoint Wealth team donated and handed out close to 100 brown bag lunches to the unhoused and other people in need at the footsteps of the Cathedral of the Blessed Sacrament in Downtown Sacramento two Tuesday’s ago.

During this Community Volunteer Day, the TPW team connected with this underserved sector of our community, directly helping unhoused people in dire need of basic necessities like food, water, clothing, and in some instances, pet food.

While the recent surge of the unhoused population in our region has split community leaders looking for solutions, we at Towerpoint Wealth were proud to do our small part in helping meet the basic needs of the most in need, at least for one day.

To find out how you can help and to learn more about this program, please visit https://www.cathedralsacramento.orgministries and refer to the Brown Bag Lunch Ministry.

Here are some of our top trending moments at Towerpoint you might have missed on our social platforms.

Click the images below!

What else is happening with the Towerpoint Wealth family?

Are you a technology director, VP, or engineer? Are you receiving restricted stock units, or RSUs, as a meaningful component of your overall compensation package?

Click below to watch our brand-new educational video, featuring our President, Joseph F. Eschleman, CIMA®, who discusses in detail how to manage RSU compensation packages for technology directors, VPs, and engineers.

Joseph specifically touches on:

- How to reduce the risk of receiving and holding your restricted stock units.

- How to structure a tax-efficient RSU “unwind” strategy.

- How to best manage the capital gains consequences of selling your RSUs.

- How to protect against becoming too “concentrated in your employer.”

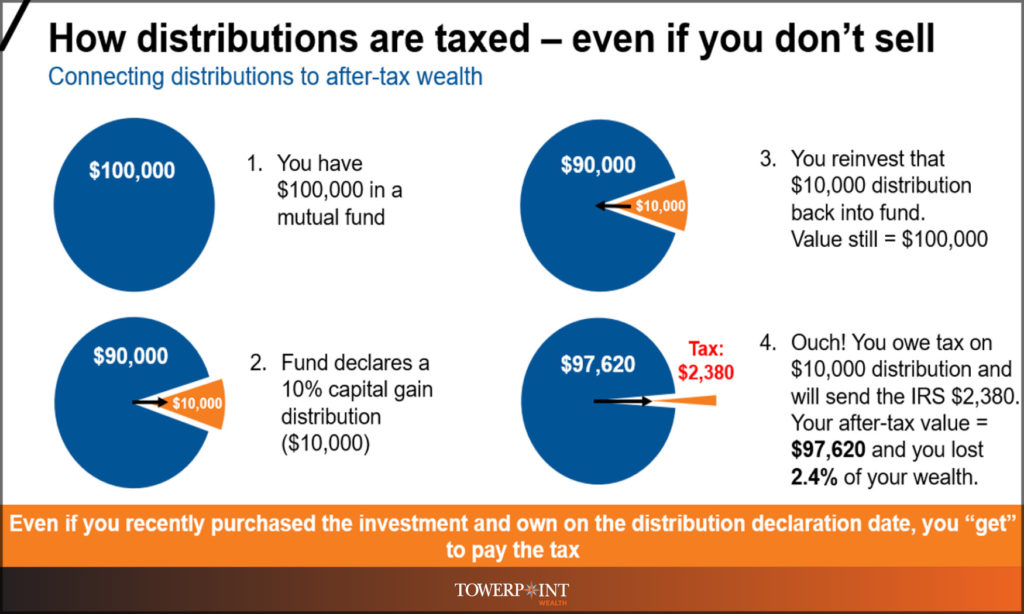

If you consciously decide to hold – and not sell – shares of a mutual fund you hold in a “regular,” non-retirement account such as an individual, joint, or trust account, then you don’t have to pay capital gains taxes, right? For better or worse, sometimes the answer is WRONG!

You may be dealt an unexpected tax bill in 2022 that you may not be ready for and certainly did not ask for – a short or long-term capital gain distribution, which is a taxable event resulting from the fund’s manager selling shares or securities held within the fund.

Before it is too late (many funds make these distributions in early or mid-December), contact us or click below to message our Director of Tax and Financial Planning, Steve Pitchford, to request a complimentary analysis of your potential 2022 capital gains tax exposure.

Have you considered specific 4Q, 2022 tax-planning and tax-reduction opportunities, before December 31 comes and goes?

Useful and interesting content we’ve read over the past two weeks:

| 1.Recent commentary and news stories about the midterm elections (in some cases, not for the faint of heart!) RealClearPolitics – 11.3.2022 Democrats Aren’t Lauging at Dr. Oz Anymore Why Republican Attacks on Crime are so Potent How Low Can the Herschel Walker Campaign Go? Friendly Reminder: Sen. Warnock Has a Lot of Baggage The Missing Factor in the Election Story: Turnout |  |

| 2. What Do Thieves Do with a Stolen iPhone? iMobie – 9.28.2022 It is quite annoying if the iPhone was stolen which could release your privacy and also cause some losses. Therefore, you have to know what to do if your iPhone was stolen in time which may help you to get back your iPhone and protect the data. For example, you may need to know how to locate a lost cell phone even when it’s turned off, how to use Find My, etc. Besides, This article will discuss what will happen to the stolen iPhone. |  |

| 3.Texas Goes Permitless on Guns. Police Face Armed Public NY Times – 10.26.2022 Many sheriffs, police leaders and district attorneys in urban areas of Texas say there has been an increase in people carrying weapons and in spur-of-the-moment gunfire in the year since the state began allowing most adults 21 or over to carry a handgun without a license. At the same time, mainly in rural counties, other sheriffs said they had seen little change, and proponents of gun rights said more people lawfully carrying guns could be part of why shootings have declined in some parts of the state. |  |

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

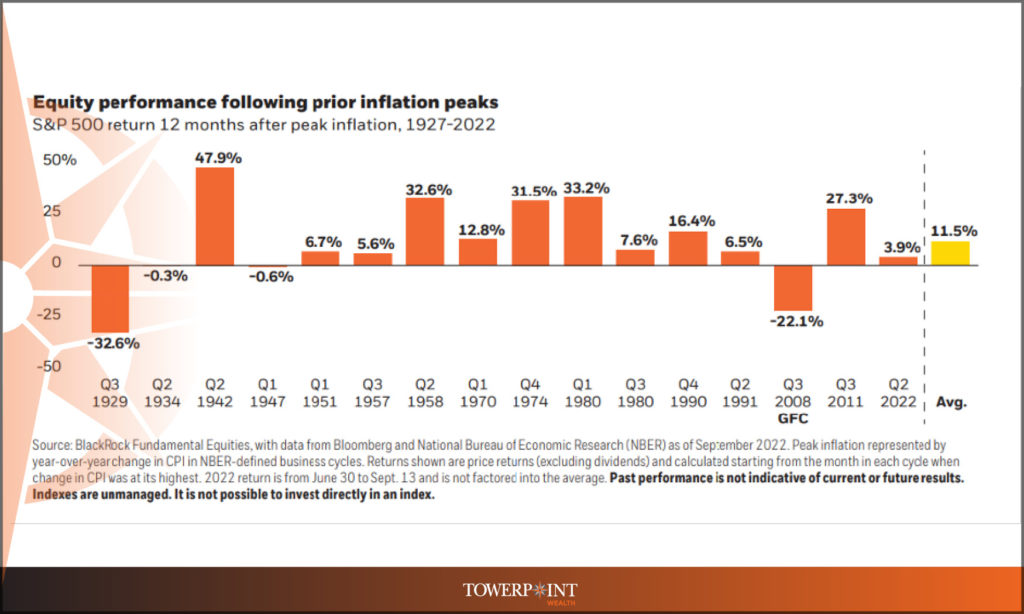

Have we reached peak inflation?

The stock market has historically rallied after inflation peaks (as measured by the CPI).

Since 1927, the average return for the S&P 500 in the 12 months following a peak in CPI was +11.5%.

Was June’s CPI figure of +9.1% the peak inflation rate for this current inflationary cycle? Based on the chart below from Blackrock, we are hopeful the answer is yes.

Concerned about inflation? At Towerpoint Wealth, we can help you - let’s talk about it!

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

While the global 24/7 news cycle churns, twists, and turns, here are a number of fun, local trending events of note:

- The 2021-2022 NBA-champion Golden State Warriors visit the Sacramento Kings on November 13

- The Beatles Guitar Project, celebrating the 55th anniversary of the Beatles 1967, visits the Sacramento Memorial Auditorium on November 13

- The Book of Mormon continues its tour at the SAFE Credit Union Performing Arts Center, through November 13

- Betty Wine Bar and Bottle Shop set to open in November

- Comedian Whitney Cummings, live at the Punch Line from November 17-19

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Joseph Eschleman, Jonathan, Steve, Lori, Nathan, Michelle, and Luis

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity.

We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on Twitter