Welcome To Our Blog

Welcome to our blog, your go-to source for insights, updates, and expert perspectives on wealth management, financial planning, and market trends. Here, you’ll find practical guides, timely news, and thought leadership designed to help you make informed financial decisions and stay ahead in an ever-changing financial landscape.

What Tax Strategies Can Help Reduce Taxes In Retirement?

Understanding the interaction between Social Security benefits and required minimum distributions rmds is essential, because required minimum distributions and Social Security income can push income into a higher tax bracket, increasing your federal income tax bill, state and local taxes, and capital gains tax imposed on selling investments or mutual funds within taxable accounts. Tax laws in 2025 and beyond are changing the treatment of taxable accounts, tax deferred accounts, and roth accounts, which means retirees must consider tax implications, tax treatment, and their long term tax situation as part of their retirement planning.

How Often Should My Investment Portfolio Be Reviewed?

Regular portfolio reviews are a foundational element of a sound financial plan. As your life circumstances and financial situation evolve, so should your investment strategy. These periodic reviews are opportunities to ensure that your investment portfolio reflects your investment objectives, risk tolerance, and desired asset allocation.

When Should I Start Estate Planning and What Documents Do I Actually Need?

Estate planning matters because life is unpredictable. Without proper planning, state laws determine what happens to your estate, your property, and in some cases your children. This can lead to delays, unnecessary costs, and family disputes during an already difficult time. A thoughtful estate plan brings structure and guidance when it matters most.

Supporting Adult Children Without Undermining Your Own Financial Goals

For many families, providing financial help to adult children begins with the best of intentions. It starts as a temporary bridge. A moment of support during a transition. A way to help them get on their feet. Over time, though, what starts as shorter-term assistance can quietly become an ongoing commitment — often without a clear plan, timeline, or shared expectations.

What is the Difference Between Wealth Management and Financial Planning?

At Towerpoint Wealth, we work with individuals across many stages of life, from professionals building financial stability to high net worth individuals managing substantial wealth. While both financial planning and wealth management aim to improve financial health, the scope, depth, and ongoing nature of these services vary in meaningful ways.

How Do I Know If I Need a Fiduciary Financial Advisor or a Traditional Advisor?

A financial advisor can act as a trusted partner, but the title alone does not guarantee that your interests come first. Some financial professionals are legally required to act in your best interest while others are not.

How Can I Feel Truly Financially Secure? A Holistic Guide to Financial Peace of Mind

One of the most practical ways to achieve financial stability is to build an emergency fund. This fund serves as a safety net when life throws you a curveball. Whether it’s a medical bill, a car breaks down unexpectedly, or a job layoff, emergency savings ensure you’re financially prepared. A good starter emergency fund should cover at least three to six months of living expenses. Ideally, these funds should be kept in a separate savings account to remain accessible and untouched.

2026 Market Outlook: What We Know, What We Don’t, and Why Planning Matters More Than Prediction

As we head into 2026, it’s natural for investors to ask a familiar question: What does the market outlook look like from here? After several years of rapid shifts, elevated

What Should I Be Doing About Healthcare and Long Term Care Costs?

Healthcare costs in retirement continue to climb faster than general inflation. Retirement research shows that medical costs accumulate gradually but persistently over time. About half of retirees report that health care spending is higher than expected, and one third say medical expenses are one of their top financial stressors.

Do I Really Need a Financial Advisor?

A financial advisor is more than just someone who tells you where to invest. A true fiduciary advisor, or financial planner, helps you build, preserve, and transfer wealth with purpose and personalized guidance.

What’s the Right Strategy for Social Security? A High-Net-Worth Guide to Maximizing Benefits

A well-structured Social Security strategy helps preserve investable assets, maximize your Social Security payments over time, and integrate seamlessly into your broader retirement planning. As your certified financial planner, our role is to ensure you collect benefits based on a plan that considers your earnings record, marital status, life expectancy, and long-term goals.

How Should I Invest In This Market With All The Volatility, Elections, and Global Risks?

At Towerpoint Wealth, a registered broker dealer, we believe that today’s turbulence presents both challenges and opportunities. Rather than react to daily market swings, we help our clients focus on the fundamentals, tailoring an investment strategy that reflects their financial goals, risk tolerance, and the risks involved in a volatile global landscape.

What High-Confidence Investors Do Every January: January Financial Resolutions

The new year isn’t about reinventing their entire financial life. It’s often simply about re-centering it. Rather than creating quick goals based on headlines or emotion, they use January as a moment to step back, reconnect with their longer-term plan, and reinforce the structures that support lasting financial confidence.

Will I Ever Be Able to Buy a Home? A Financial Planner’s Guide to Turning Hope into Strategy

This article aims to guide you step‑by‑step through what the data says, who still can realistically buy, common pitfalls, and how to position yourself to turn aspiration into achievement.

How Do I Build an Emergency Fund: A Strategic Guide for Protecting Your Wealth

For professionals, retirees, business owners, and high-net-worth individuals, building an emergency fund is about preserving long-term wealth. It ensures that when unplanned expenses arise, your financial strategy doesn’t need to be disrupted. Whether it’s covering rent or mortgage payments during a temporary income gap or paying for medical bills without touching your investments, emergency savings give you options.

What Tax Strategies Can Help Reduce Taxes In Retirement?

Understanding the interaction between Social Security benefits and required minimum distributions rmds is essential, because required minimum distributions and Social Security income can push income into a higher tax bracket, increasing your federal income tax bill, state and local taxes, and capital gains tax imposed on selling investments or mutual funds within taxable accounts. Tax laws in 2025 and beyond are changing the treatment of taxable accounts, tax deferred accounts, and roth accounts, which means retirees must consider tax implications, tax treatment, and their long term tax situation as part of their retirement planning.

How Often Should My Investment Portfolio Be Reviewed?

Regular portfolio reviews are a foundational element of a sound financial plan. As your life circumstances and financial situation evolve, so should your investment strategy. These periodic reviews are opportunities to ensure that your investment portfolio reflects your investment objectives, risk tolerance, and desired asset allocation.

When Should I Start Estate Planning and What Documents Do I Actually Need?

Estate planning matters because life is unpredictable. Without proper planning, state laws determine what happens to your estate, your property, and in some cases your children. This can lead to delays, unnecessary costs, and family disputes during an already difficult time. A thoughtful estate plan brings structure and guidance when it matters most.

What is the Difference Between Wealth Management and Financial Planning?

At Towerpoint Wealth, we work with individuals across many stages of life, from professionals building financial stability to high net worth individuals managing substantial wealth. While both financial planning and wealth management aim to improve financial health, the scope, depth, and ongoing nature of these services vary in meaningful ways.

What Should I Be Doing About Healthcare and Long Term Care Costs?

Healthcare costs in retirement continue to climb faster than general inflation. Retirement research shows that medical costs accumulate gradually but persistently over time. About half of retirees report that health care spending is higher than expected, and one third say medical expenses are one of their top financial stressors.

Is It Smarter to Pay Down My Debt or Invest Extra Cash? A Strategic Guide for High-Net-Worth Individuals

Is It Smarter to Pay Down My Debt or Invest Extra Cash? A Strategic Guide for High-Net-Worth Individuals Deciding whether to pay down debt or invest extra cash is one

How Much Should I Keep in Cash vs Investing It?

How Much Should I Keep in Cash vs Investing It? Deciding how much cash to keep versus how much to invest is one of the most foundational decisions in personal

What Is Tax Lien Investing? A Comprehensive Guide For Wealth‑Minded Investors

A tax lien is a legal claim by the government against the property until the unpaid property taxes and associated tax debt are resolved.

How to Apply for Social Security Benefits at Age 62: A Detailed Guide to Early Retirement Benefits

Applying for Social Security retirement benefits at age 62 is a major decision with long‑lasting consequences. In this guide we explain how to apply for social security benefits at age

Is $2 Million Enough to Retire? 5 Steps to Retiring with $2 Million

As you build your retirement nest egg, you’re probably wondering if you have enough set aside to fund the lifestyle you crave in your “golden years”. You’ve worked your entire

How a Financial Advisor Helps You Protect and Grow Net Worth 07.07.2024

Building and Protecting Personal Net WorthEmotional Awareness – Strike a Balance between Life Now and Planning for LaterFinancial Advisor vs Financial PlannerFind a Financial Advisor Who Will Understand Your Specific

What is an RSU? | Restricted Stock Units, RSUs and Stock Options

Updated November 2024. Restricted Stock Units (RSUs) can be a significant component of an employee’s compensation package. But what is an RSU package? Do you have an RSU strategy? How

Real Estate Investing From Properties to Profits, Part One 01.25.2024

From Properties to Profits: Part One Mastering Taxes as a Real Estate Investing Pro!AUTHOR: MEGAN M. MILLER, EA, Associate Wealth Advisor, Towerpoint Wealth MEGAN M. MILLER, EA With a bachelor’s

Maximizing an Inheritance Estate Planning 01.21.2024

Navigating the Tax Laws to Maximize | Your Beneficiary’s Inheritance | Comprehensive Estate Planning When most individuals are establishing an estate plan, they generally only think about the tax consequences

What Estate Planning Documents Do I Need? 01.21.2024

Estate planning documents specify how you want your assets distributed upon incapacity or death. The collection of these documents together is called an Estate Plan. Some people don’t believe they

How Do I Know If I Need a Fiduciary Financial Advisor or a Traditional Advisor?

A financial advisor can act as a trusted partner, but the title alone does not guarantee that your interests come first. Some financial professionals are legally required to act in your best interest while others are not.

How Can I Feel Truly Financially Secure? A Holistic Guide to Financial Peace of Mind

One of the most practical ways to achieve financial stability is to build an emergency fund. This fund serves as a safety net when life throws you a curveball. Whether it’s a medical bill, a car breaks down unexpectedly, or a job layoff, emergency savings ensure you’re financially prepared. A good starter emergency fund should cover at least three to six months of living expenses. Ideally, these funds should be kept in a separate savings account to remain accessible and untouched.

What Is a Fiduciary Financial Advisor? Why It Matters More Than Ever in 2025

A fiduciary financial advisor is a professional who is legally obligated to act in the best interests of their clients.

Fall 2025: Fiduciary Insights on the One Big Beautiful Bill & Client Protection Strategies

Welcome to the Fall 2025 edition of Towerpoint Wealth’s Fiduciary Group Newsletter, Fiduciary Focus! We hope you find this newsletter both informative and empowering as you continue to uphold the highest standards of fiduciary care.

Summer 2025: Navigating Volatility with Strategy and Stability

As we enter the second half of the year, this edition focuses on timely developments—including the market reaction to new tariffs, core principles of tax-efficient investing, and insights to support you in managing complexity with confidence.

The Secure Act Impact on Inherited IRAs: 5 Things Every Fiduciary Must Know

Welcome to our 2025 edition of Fiduciary Focus! In this issue, we’re going to dive into the new Inherited IRA & Required Minimum Distribution (RMD) rules under SECURE Act 2.0 and their implications for fiduciaries managing trusts.

The Fiduciary’s Role in Real Estate: Calculating ROI for Smarter Investments

Welcome to the Fall edition of Towerpoint Wealth’s Fiduciary Group’s Newsletter – Fiduciary Focus! As fiduciaries, we recognize the importance of safeguarding our clients’ assets. Our goal is to equip

Considering the Effects of Inflation and Deflation 08.02.2024

Welcome to the second edition of Towerpoint Wealth’s Fiduciary Group’s Newsletter – Fiduciary Focus! As we are also held to a fiduciary standard, we understand the weight of our

Your Essential Newsletter for Trust Administration and More 04.10.2024

Introducing Fiduciary Focus, Towerpoint Wealth’s new newsletter for the fiduciary community. Welcome to the first edition of Towerpoint Wealth’s Fiduciary Group’s Newsletter – Fiduciary Focus. Our growing team is excited to

6 Smart Tax Moves To Make Before Filing Your Taxes

Our latest episode “6 Smart Tax Moves To Make Before Filing Your Taxes” is designed to help you take charge of your financial future this tax season. In this episode, host Joseph Eschleman, CIMA®, President of Towerpoint Wealth,

Stewards of Integrity: The Vital Role of Private Professional Fiduciaries

In this episode of A Wealth of Knowledge, we shine a spotlight on the vital and multifaceted role of private professional fiduciaries. Hosted by Joseph Eschleman, President of Towerpoint Wealth, this episode features

Navigating the 2024 Tax Season: Your Top 6 Questions, Answered! Season 2, Episode 1

Welcome to the Season 2 premiere of “A Wealth of Knowledge,” where we’re plunging into the depths of wealth management to equip you with indispensable guidance and expertise for safeguarding

Why T-Bills May Be Better than CDs! Season 1, Episode 5

Dive Deeper: Treasury Bills vs. Certificates of Deposit in an all new episode of @twrpointwealth “A Wealth of Knowledge” Podcast – Join President Joseph and special guest advisor @jlattt in this episode as they

Reducing the Necessary Evils of Investing: Expenses and Taxes Season 1, Episode 4

In this episode, our President, Joseph Eschleman, CIMA®, and our Director of Tax and Financial Planning, Steve Pitchford, CPA, CFP®, as they unravel the complexities of managing and reducing the “necessary evils” of

9 Tax Strategies Real Estate Investors Wish They Had Known Season 1, Episode 3

In this episode Megan Miller and Joseoh Eschleman talk about the 9 tax strategies real estate investors must know. As Towerpoint Wealth’s President and founder, Joseph provides customized financial planning

Real estate market in Sacramento Season 1, Episode 2

My what a difference 18 months makes! Do you own real estate in the greater Sacramento area? Recently bought a home here? Or, just thinking about buying or selling real

Economy in Recession? Season 1, Episode 1

Economy in Recession? Five specific strategies to help you recession-proof your portfolio LISTEN NOW! Economy in Recession? | Five specific strategies to help you recession proof your portfolio Is the

How Do I Protect My Money From Inflation? Proven Strategies for Preserving Wealth

In this guide we explore the most effective, research‑backed ways to preserve value, outpace inflation, and build a resilient, diversified investment portfolio tailored to long-term goals.

Am I On Track for Retirement? A High-Net-Worth Guide to Financial Readiness

Being on track for retirement means having the financial stability to maintain your lifestyle after you stop working. It involves aligning your retirement budget with your retirement income and managing your investments, taxes, and expenses with discipline and foresight.

6 Smart Tax Moves to Make Before Filing Your Taxes

Tax season is fast approaching, and if you’re aiming to reduce your obligation to Uncle Sam in 2025, now is the time to get informed and take action. In our latest A Wealth of Knowledge podcast, we explore “6 Smart Tax Moves to Make Before Filing Your Taxes.”

What Is Happening With The Social Security Fairness Act?

The Social Security Fairness Act (SSFA) was signed into law by President Biden on January 5, 2025. This eliminates the “Windfall Elimination Provision” (WEP) and the “Government Pension Offset” (GPO)

Building Bright Futures: Top 4 College Savings Plans to Consider

Planning for your child’s college education can feel overwhelming—but it doesn’t have to be! With tuition costs climbing every year, and limited access to financial aid, having a solid savings

Our Latest Podcast Episode – Exploring the World of Private Professional Fiduciaries

In our latest episode of “A Wealth of Knowledge”, Towerpoint Wealth’s original podcast, we dive into the intricate world of private professional fiduciaries. These trusted professionals play a critical part

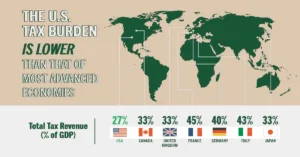

How Does the U.S. Tax Burden Stack Up? 06.27.2024

The comparative tax burdens between the United States and several other advanced economies. The central message highlights that the U.S. has a significantly lower tax burden, with total tax revenue

Maximize stock compensation and RSU selling strategy video 06.07.2024

Compensation packages for directors, VPs, software engineers, or other employees of technology based firms almost always contain restricted stock units, or RSUs. If you own RSUs, you may be asking

Will you have enough money to retire? 05.03.2024

4 Reasons You Might Fall Short of Your Retirement Plan When you find yourself daydreaming about retirement, does your dream retirement entail traveling the world? Dedicating time to beloved hobbies?

20 Common Investing Mistakes 12.06.2023

Understanding that the world of investing and wealth-building is filled with opportunity, not only for growth but also for errors, at Towerpoint Wealth we believe our role is to raise

Money in T-Bills or CDs | Which is better: T-Bills or CDs? 10.19.2023

Compare Treasury bill —T-bill— rates with bank CD best rates. T-bill rates today are often as competitive, and oftentimes more competitive, than the interest rates offered on CDs. But this

FIRE Investing for Financial Independence! 08.21.2023

Empower yourself with this strategy for financial independence, early retirement, and peace of mind. More than a hot trend, FIRE investing principles have been guiding wealthy, independent people towards financial independence

Is $2 Million Enough to Retire 06.04.2023

A 2020 survey from Schwab Retirement Plan Services found that the average worker expects to need roughly $1.9 million to retire comfortably. Is $2 million enough to retire? Is retiring with 2 million

Six Questions to Ask When Hiring a Financial Advisor 05.05.2023

Are you on the hunt for a high-quality financial advisor? There are (literally) thousands of people who hold themselves out as financial advisors just in California alone! How can you

West Sacramento Real Estate Investment Meet Up 04.15.2023

Most investors know, exposure to real estate in a financial portfolio provides opportunities to grow net worth. In America, there are basically two tax systems: one for those in the

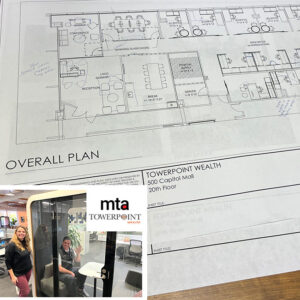

Towerpoint Wealth Featured on Sacramento Business Journal 08.16.2024

Our recent expansion has led to a Sacramento Business Journal feature of our firm! We evaluated seven different new physical office locations, but decided to stay in the BMO Tower

Maximizing Your ROI: A Guide for Real Estate Investors 08.14.2024

Real estate ROI, or return on investment, measures the profit earned on a real estate investment after all costs of the investment are deducted. Your real estate ROI is a

Is Crypto Worth Investing In? 05.23.2023

Did you see Joseph Eschleman, CIMA® on ABC10 last night??!! ???? Lora Painter interviewed our President about “The Truth about Crypto” and how it can be considered as a potentially complementary part of a #properlydiversified investment portfolio.

Do you need to pay taxes on money given to you in a will? 03.20.2023

Towerpoint Wealth’s President, Joseph Eschleman, was the go-to financial expert on ABC10 News’ March 20 feature story. A guest on ABC10’s Dollars and Sense segment, Joseph explained the four different taxes people need to be

Investing 2022: Painful or Profitable? 12.19.2022

Kathleen Doler, senior writer for Investor’s Business Daily (IBD), recently published a front-page story in IBD about investing in 2022, how it humbled many investors and financial advisors, and what they did

President Joseph Eschleman Discusses the 2022 Midterm Elections on ABC10 11.8.2022

Connecting with ABC10 evening anchor Lora Painter for a productive interview ahead of the 2022 midterm elections, Joseph weighed in last night with some key points and considerations, specifically touching

Towerpoint Wealth’s President featured on ABC10 10.13.2022

Our President, Joseph Eschleman, was featured last night in evening anchor Lora Painter’s story on ABC10’s 11 p.m. news! Joe discussed with Lora the *big* announcement made yesterday by the

Where to stash your cash 07.21.2022

Holding and intelligently divesting cash during a market rough patch has both pros and cons — evaluating these risk/return tradeoffs are even more challenging with rampant inflation just another issue

Towerpoint Wealth’s President Featured in the Sacramento Bee 06.29.2022

Our President, Joseph Eschleman dove into a number of specific opportunities and valuable money-saving tips to navigate today’s inflationary environment with Sacramento Bee reporter Hanh Truong, in her recent article: “Should You Keep Cash On

Towerpoint Wealth’s President featured in Investor’s Business Daily 06.24.2022

In an unsettled world where stock prices are declining and uncertainty is rising, many fear an economy in recession here in the United States. While recession is by no means

Leading by Example with Joe Eschleman – LifeBlood Podcast 04.18.2022

Described as “a human wellbeing and flourishing podcast,” LifeBlood is released daily and features a myriad of different professionals and subject matter experts. Produced and hosted from Scottsdale, AZ by George Grombacher, our

President Joseph Eschleman Featured in Financial Advisor IQ Magazine 02.25.2022

Our President, Joseph F. Eschleman, CIMA®, was recently profiled in Financial Advisor IQ’s February 25 article discussing what clients need to know about Russia’s invasion of Ukraine, the impact these developments may have

Joseph Eschleman, CIMA®Heart 2 Biz Podcast 09.23.2021

Our President, Joseph Eschleman, was the featured guest on Laurel Sagen and Shasta Escalante’s Heart 2 Biz podcast earlier this month. Heart 2 Biz is a weekly podcast focused on

Five Things I Wish Someone Told Me Before I Became A Founder 02.12.2021

Our President, Joseph F. Eschleman, CIMA®, was interviewed by Candice Georgiadis, a contributing writer to Authority Magazine, as part of her series about leadership lessons of accomplished business leaders. Joseph’s

Towerpoint Wealth’s President Featured in Financial Advisor IQ Magazine

Our President, Joseph F. Eschleman, CIMA®, was profiled in Financial Advisor IQ’s October issue, discussing how the proper use of social media helps independent wealth management firms, and individual advisors, to establish thought

Did Biden Sign the Social Security Fairness Act? What It Means for Public Employees and Retirees in 2025

The Social Security Fairness Act (H.R. 82) was enacted into law on January 5, 2025 when President Joe Biden signed the Fairness Act into law at the White House. That answered the question, “did Biden sign the Social Security Fairness Act,” with a resounding yes.

The Tariff Tantrum and the Benefits of Bonds

At Towerpoint Wealth, what we do know is this: uncertainty tends to push investors toward safety. And fortunately, if you are a client of the firm, you have a significant “dose” of defensive assets comprising your portfolio.

Trade Wars, Tariffs, and Navigating Market Risk

Recent news on tariffs and government job cuts has raised concerns about a possible trade war, resulting in a market pullback with the Nasdaq now near correction territory. While market swings are never pleasant, we believe it’s important to maintain perspective, especially when it comes to your long-term financial goals.

Health Care & Your Retirement: Key Takeaways from Our Live Webinar

During this comprehensive workshop, we tackled the most pressing concerns about health care both before and during retirement, providing expert guidance to help you make informed decisions. Here’s a breakdown of what was discussed:

The California Los Angeles Fires: A Community Call to Action

The recent fires in Los Angeles have highlighted the devastating toll wildfires can take on our communities. At Towerpoint Wealth, these fires have hit especially close to home. Our Advisor

Celebrating Client Partnerships and New Beginnings

A Recap of the Towerpoint Wealth Open House! Last week, we had the pleasure of opening our new doors to friends, clients, and colleagues for an unforgettable Open House event. Held at our new headquarters at

TPW Getting Our Learn On!

Earlier this week we hosted a continuing education event for our Wealth Advisors focused on reverse mortgages. Featuring Scott Roseveare, President and Founder of Live Better Financial, the session explored key

Exploring the Future of Wealth at FutureProof Festival 09.16.2024

Our Partner, Wealth Advisor, Jonathan LaTurner, and Director of Research and Operations, Nathan Billigmeier, are attending FutureProof, the world’s largest wealth management “festival,” in Huntington Beach, where they are already immersed

Shriners Children’s Northern California Community Day 06.21.2024

Sweet moments and even sweeter smiles! Our Towerpoint Wealth team enjoyed a fulfilling Community Day at Shriners Children’s Northern California yesterday afternoon. We hosted a 90 minute ice cream/arts and crafts social, helping

Front Street Animal Shelter Community Day 12.19.2023

Last week, the Towerpoint Wealth team carved out a full morning to dedicate some time (and a little grit and elbow grease) to support the Front Street Animal Shelter’s Pet Food Pantry program.

Thank you and Merry Christmas, Ascent Builders! 12.12.2023

In the spirit of enduring partnership, Scott Kelly and Patty McElwain stopped by the Towerpoint Wealth headquarters yesterday to drop off their MUCH-anticipated Christmas wreath! This emblematic gesture not only

Building the Future at TPW! 11.15.2023

Earlier this week, our President, Joseph Eschleman, and Partner, Jonathan LaTurner (seen above, waving!) explored the perfect furnishings for our new office space, set to elevate our new workspace in

Luis Barrera Attends the 2023 Digital Summit in San Diego 10.27.2023

Our Marketing Specialist, Luis Barrera is taking San Diego by storm at the Digital Summit. We are happy to support Luis’ journey of learning new marketing skills, expanding his marketing

TPW Webinar: AI Decoded: Unlocking the Secrets of Artificial Intelligence! 11.06.2023

Everyone is talking about Artificial Intelligence (AI). What is the AI question top of your mind? In today’s rapidly evolving tech landscape, the AI user experience affects everything we do.

Supporting Adult Children Without Undermining Your Own Financial Goals

For many families, providing financial help to adult children begins with the best of intentions. It starts as a temporary bridge. A moment of support during a transition. A way to help them get on their feet. Over time, though, what starts as shorter-term assistance can quietly become an ongoing commitment — often without a clear plan, timeline, or shared expectations.

2026 Market Outlook: What We Know, What We Don’t, and Why Planning Matters More Than Prediction

As we head into 2026, it’s natural for investors to ask a familiar question: What does the market outlook look like from here? After several years of rapid shifts, elevated

What High-Confidence Investors Do Every January: January Financial Resolutions

The new year isn’t about reinventing their entire financial life. It’s often simply about re-centering it. Rather than creating quick goals based on headlines or emotion, they use January as a moment to step back, reconnect with their longer-term plan, and reinforce the structures that support lasting financial confidence.

Second Homes and a Softening Housing Market: What Affluent Buyers Need to Know in 2026

For the past several years, even higher-income households have found themselves asking a question they may not have expected a decade ago: “Will I ever be able to buy a

Charitable Giving: How to Make the Most Tax Impact This Holiday Season

In this Thanksgiving edition of Trending Today, we’ll walk through a number of charitable giving strategies that can help you make a bigger impact, potentially reduce your tax bill, and integrate generosity AND tax efficiency into your broader financial and retirement plan.

Time, Not Timing: Why Longer-Term Investing Wins

Many investors dream of perfect timing — buying right before the market soars, and selling just before it dips. However, oftentimes, investors do the opposite. In theory, market timing is

The Hidden Cost of Holding Too Much Cash: How Cash Drag Can Erode Your Wealth

In this article, we’ll discuss the hidden costs of holding cash, why excess liquidity often works against you, and how a thoughtful cash flow management strategy can strike the right balance between peace of mind and portfolio growth.

A Financial FESTIVAL? Future Proof 2025 Takeaways for Advisors and Investors

Every year, thousands of financial professionals gather at what has quickly become one of the most talked-about events in wealth management: the Future Proof Festival in Huntington Beach, CA. And

What Changes Are Coming to Social Security in 2025: What You Need to Know

In this article we explain the most important updates, what to watch, and how to adjust your planning.

The One Big Beautiful Bill Act (OBBBA): What Investors Need to Know

As we’re sure you’ve heard, in July 2025, Congress passed what’s being called the One Big Beautiful Bill Act — or OBBBA for short. At nearly 1,000 pages, this legislation

Trump’s Tariffs in Effect: What Tariffs on Imports Mean for Everyday Americans and Investors

It’s official. As of this month, tariffs on imports are officially in effect — and while that may sound like a headline for economists or politicians, the reality may hit

The Great Wealth Transfer: How to Prepare for the $84 Trillion Intergenerational Shift

In this article, we’ll talk about why the great wealth transfer is such a big deal, the most common mistakes families make, and how fiduciary planning can help ensure your family’s wealth doesn’t just survive the transition, but grows stronger because of it.

Your Estate Planning Checklist: 10 Steps to Avoid Common Estate Planning Pitfalls

Contrary to popular belief, estate planning is NOT just about what happens after you’re gone. It’s about making sure your wealth, values, and intentions are both documented and protected —

How to Plan for Longevity Risk in Retirement

Most people dream of a long, fulfilling retirement. But what if living longer, a gift in many ways, quietly puts your financial future at risk? At Towerpoint Wealth, we believe

The Psychology of Market Cycles: Why Investors Buy High and Sell Low

When it comes to investing, the goal is simple: buy low, sell high. But as any experienced investor knows, the reality can be far more complicated. Despite having access to