Towerpoint Wealth’s Ideal Client / Professional Fees

Clients of Towerpoint Wealth come from various backgrounds, but all share a common goal–to grow and preserve their wealth, and to either achieve, or maintain, their financial independence. We believe most of our clients value what money can do for them, but do not have the time, depth of knowledge, or interest to properly coordinate all of their financial affairs, research their own investments, or design a successful longer-term financial plan. Instead, they seek a team of professionals that can help them make objective and smart decisions about their financial future. Our clients include pre-retirees, retirees, business owners, corporate executives, industry professionals, and individuals who have recently experienced a significant life event, such as the death of a spouse, a divorce, or a job or career change.

Ten Attributes of a Towerpoint Wealth Ideal Client

- Are willing to be open with us about their personal and

financial lives. - Have reasonable expectations about things out of anyone’s control, such as the financial markets, the economy, and politics.

- Have at least one of the following criteria:

→ A personal net worth of $2,500,000

→ Personal household income of $250,000

→ Personal investable assets of $750,000

→ An entrepreneur with gross business revenue of $5,000,000

→ A business with a company retirement plan of $2,000,000. - Are able to handle the truth, no matter what, and demonstrate a willingness to synthesize, accept, and act on our recommendations and counsel.

- Seek a comprehensive relationship that accounts for all aspects of their financial and economic lives.

- Respect the value of our relationship and our fee structure.

- Understand the difference between not micro-managing, yet not completely falling asleep at the wheel.

- Are responsive to phone calls, letters, and emails.

- Welcomes and appreciates our high-touch team approach to client service.

- Are coachable, open to having meaningful dialogue, and are willing to ask questions and to challenge our advice and recommendations.

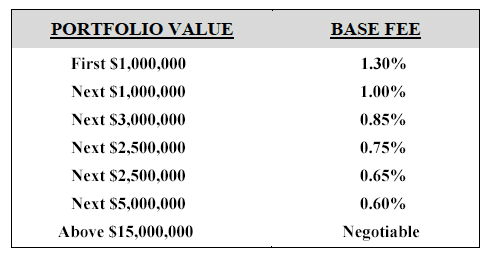

Wealth Management Fees

Towerpoint Wealth offers professional wealth management planning, counsel, and service for an annual asset-based fee, based on the amount of assets under the Firm’s management. This management fee is generally determined in accordance with the following blended fee schedule:

The annual fee is prorated and charged quarterly, in advance, based upon the market value of the assets being managed by Towerpoint Wealth on the last day of the previous billing period. If assets in excess of $50,000 are deposited into or withdrawn from an account after the inception of a billing period, the fee payable with respect to such assets is adjusted to reflect the interim change in portfolio value. For the initial period of an engagement, the fee is calculated on a pro rata basis. In the event the advisory agreement is terminated, the fee for the final billing period is prorated through the effective date of the termination and the outstanding or unearned portion of the fee is charged or refunded to the client, as appropriate. Additionally, for asset management services the Firm provides with respect to certain client holdings (e.g., held-away assets, accommodation accounts, alternative investments, etc.), Towerpoint Wealth may negotiate a fee rate that differs from the range set forth above.

Curious what the average financial advisor fees across the U.S. are? Click here to read a detailed 2017 report from Advisory HQ: https://www.advisoryhq.com/articles/financial-advisor-fees-wealth-managers-planners-and-fee-only-advisors/

Financial / Retirement Planning Fees

We utilize RightCapital® financial planning software to help our clients better, more scientifically, and more systematically plan for their financial planning and future retirement. Leveraging RightCapital®’s proprietary monte carlo simulatior allows us to truly customize your retirement plan, and more deeply explore and quantify whether your expectations and goals for your future are reasonable.

The fees for this separate service and deliverable range from $2,500-$5,000, depending on the level of complexity and sophistication of the client and the plan. This is a one-time fee and includes multiple plan revisions, the development of customized “what if” future retirement scenarios, a dedicated and comprehensive in-person review meeting, and any future updates and revisions to your customized plan. The fee is billed 50% in advance, and 50% upon completion.

For more information on our RightCapital financial planning process, or to download a sample RightCapital® financial plan, please visit our Financial Planning Process page.